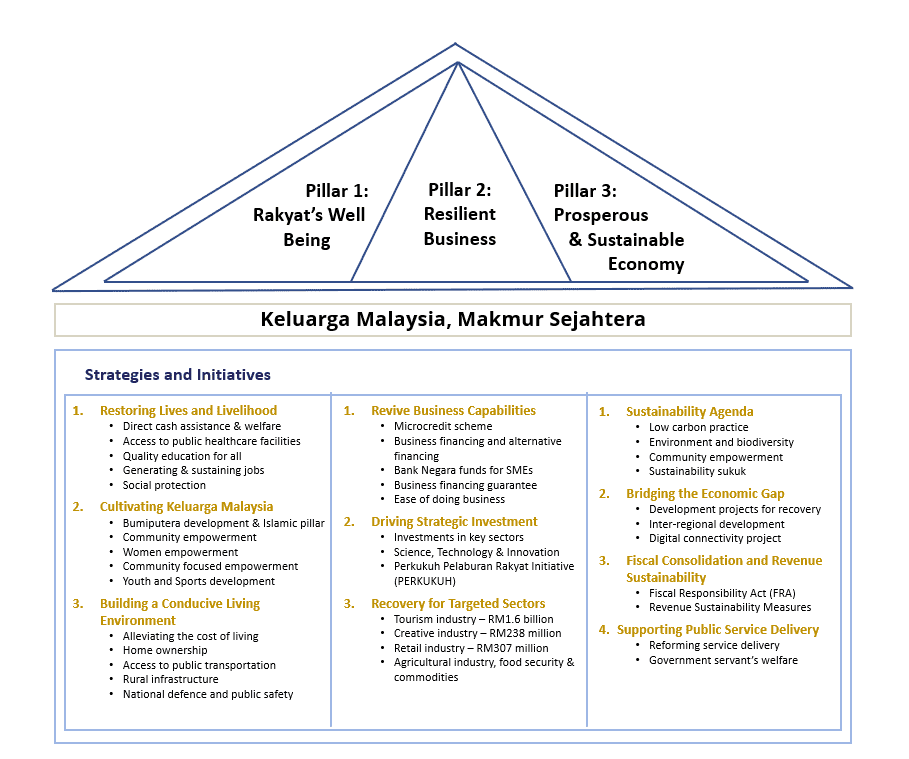

On 29 October, finance minister, Tengku Datuk Seri Zafrul Abdul Aziz delivered Malaysia’s 2022 budget in the parliament with the theme “Keluarga Malaysia, Makmur Sejahtera”. The colossal 2022 national budget amounted to RM332.1 billion, the largest-ever for the country with RM233.5 billion allocated for operational expenditure, RM75.6 billion for development expenditure and RM23 billion for Covid-19 fund.

The 2022 budget is based on three pillars and each pillar will be supported with several strategies and initiatives.

Two key matters to note about the national budget.

- The government has introduced a new Prosperity Tax (“Cukai Makmur”), a one-off tax for Year of Assessment 2022 that is to be imposed on non-SMEs that generates substantial income during the Covid-19 pandemic period. These companies will be subjected to a corporate tax of 24% on chargeable income up to the first RM100 million and the remaining changeable income will be taxed at 33%.

- The government also has made it mandatory for all public listed companies (PLCs) on Bursa Malaysia to have at least one female director. Large-cap companies must have one female director by September 2022, while all other listed companies by January 2023.

Some of the highlights of Budget 2022 in supporting business continuity and resilience

- Smart Automation Matching Grants of RM100 million to increase productivity via automation for 200 companies in the manufacturing and services sector.

- Technological transformation incentive of RM45 million for SMEs and also mid-stage companies in the manufacturing and services sector.

- Malaysia Co-Investment Fund Matching Grants of RM80 million for funding through equity crowdfunding and peer-to-peer financing platforms.

- SME Digitalisation Grant Scheme of RM200 million with RM50 million dedicated towards Bumiputera microentrepreneurs in rural areas to increase digital adoption.

- Matching Grant for Aerospace Businesses of RM100 million for Bumiputera SMEs to explore business opportunities in the aerospace segment.

- Financing for Youth Entrepreneurs with the collaboration of Bank Simpanan Nasional and Agrobank that have earmarked financing of RM150 million to facilitate youths that venture into entrepreneurship.

- Equity and Quasi-Equity Investment Scheme, a RM2.1 billion matching method through equity and quasi-equity investment to assist companies facing gearing or leverage problems led by SME Bank in collaboration with TERAJU and BSN.

- Assistance to Listed Companies on Bursa that were affected by Covid-19 pandemic will get an injection of additional funds through a government-owned SPV in the form of equity instruments or other related instruments.

- Business Financing Guarantee, an enhanced scheme with additional guarantee limit of RM10 billion to provide guarantees for loans that are being rescheduled and restructured for companies in need.

- Deferment of Income Tax Instalment Payments for Micro, Small, and Medium Enterprises (MSMEs) for a period of six months until 30 June 2022.

- Review of Tax Treatment on Unabsorbed Business Losses from the YA 2019 is allowed to be carried forward for a maximum period of 10 consecutive years of assessment and the balance if any.

- Expansion of Scope for Tax Incentives for Green Technology will be expanded to include Rainwater Harvesting System (RHS) projects that are applicable to applications received by MIDA from 1 January 2022 to 31 December 2023.

- Extension of Special Tax Deduction on Rental Reduction for Business Premises will be extended for another six months from January to June 2022.

- Extension of Stamp Duty Exemption for Loan Restructuring and Rescheduling will be extended to 31 December 2022.

- Extension of Stamp Duty for P2P Loan of Financing Agreements, a 100% stamp duty exemption will be given on P2P loan or financing agreements between MSMEs and investors for agreements executed from 1 January 2022 and 31 December 2026.

- Extension of Special Income Tax for non-Malaysian Citizen with the rate of 15% given to non-residents holding key positions (C-Suite) in companies relocating their operations to Malaysia will be extended until 31 December 2022.

The summaries below provide a good overview of the National 2022 Budget:

- Crowe Chat, Vol.7/2021 (Special Edition) | Malaysia Budget 2022: Key Highlights of Belanjawan 2022

- PwC | Centre Stage: Budget 2022 Overview

- PwC TaXavvy | Budget 2022 Edition (Part 1)

- PwC TaXavvy | Budget 2022 Edition (Part 2)

- EY Take 5 for Business, Volume 9 Issues 5 | Malaysia Budget 2022

- Thannes Tax Consulting Services | Budget 2022: Summary of Tax Measures Announced

- TgsTW | Malaysia 2022 Budget Highlights “Keluarga Malaysia, Makmur Sejahtera”

- Deloitte Tax Espresso (Special Edition) – Highlights of Budget 2022 – Part 1

- Grant Thornton | Budget 2022

- KPMG | 2022 Budget Snapshots: Keluarga Malaysia, Makmur Sejahtera

- EY Tax Snapshots | Malaysia Budget 2022

Full speech of the National 2022 Budget is available here.

Photo by Paweł Szymankiewicz on Unsplash.

1.0

1.0