Prior to the presentation of Budget 2022, this column ran a series of three articles discussing issues as to whether we should be worried about debt, why debt dependency can be a ticking time bomb and measures the government can take to address our current low tax to gross domestic product (GDP) ratio. Well, Budget 2022 was presented last week, and in short, an opportunity was missed by not addressing the elephant in the room.

Instead, Budget 2022 was a record of sorts. It is now the biggest expansionary budget that Malaysia has ever seen with a total allocation of RM332.1bil which came with the largest allocation for gross development expenditure of RM75.6bil.

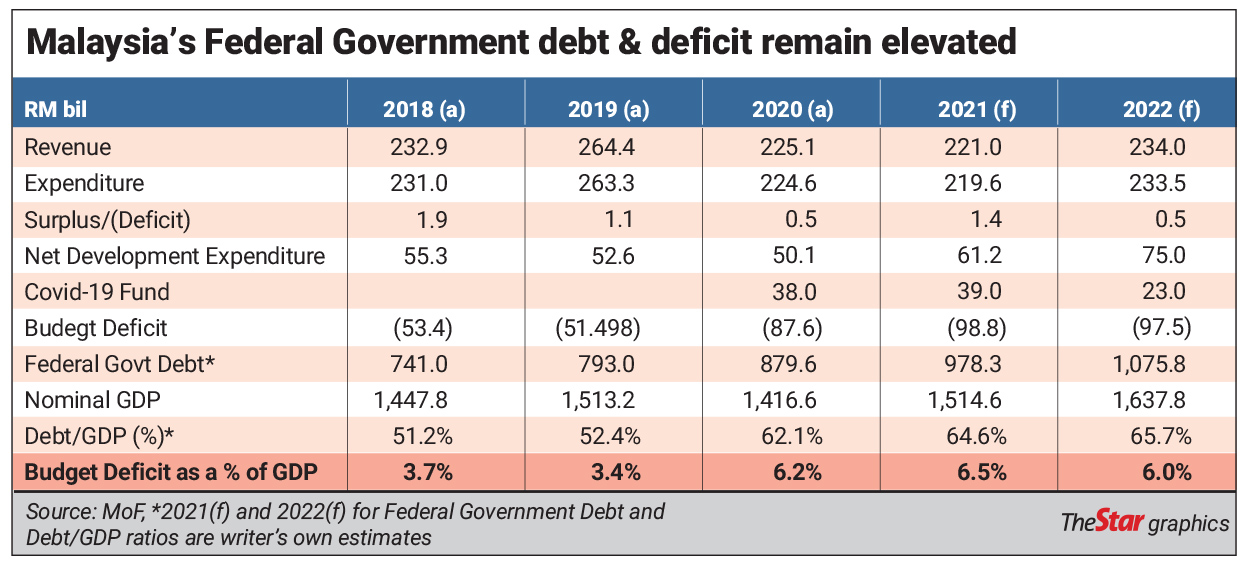

Going into the details of the budget itself, it shows Malaysia is expected to continue to run a budget deficit of RM98.8bil for this year and RM97.5bil for 2022, translating to a budget deficit to GDP of 6.5% and 6.0% respectively. This would also mean that Malaysia will be raising its overall federal government debt from RM879.7bil as at end of 2020 to as much as RM978.3bil this year and as much as RM1,075.8bil in 2022.

The table summarises Malaysia’s financial position based on data presented in the Fiscal Outlook 2022 report, with the exception of the federal government debt for 2021 level of RM978.3bil as that is based on the full year’s forecast and not based on the current level of RM958.4bil, which is the end-June 2021 figure.

The federal government debt level too is of course before taking into consideration committed guarantees (RM190.4bil); 1MDB (RM32bil); and other liabilities (RM152.9bil). If all three are added, Malaysia’s total debt at RM1,353.6bil in 2021 and rise to RM1,431.6bil next year, translating to a debt-to-GDP ratio of 89.4% and 87.4% in respectively.

Interestingly, despite the larger Covid-19 Fund of RM110bil, some RM10bil has not been allocated based on the data that was presented as it remains as a buffer and was not provided as an expenditure for based on the above forecast.

Assuming another RM10bil is spent next year, that will push the budget deficit to RM107.5bil, while both the debt-to-GDP and budget deficit as a % of GDP ratio will increase by 0.6 percentage points each to 66.3% and 6.6% respectively.

Bullish economic prospects

The headline real GDP growth is expected to increase to 5.5%-6.5% for 2022 from this year’s estimate and guided range of between 3%-4%. Interestingly, in nominal terms, the economy is expected to accelerate at a pace of between 7.7%-8.7% next year from this year’s forecast growth of between 6.4%-7.4%. For 2022, the main economic driver from the supply side of the economy is seen from the construction sector, up 11.5% y-o-y, and the services sector, with a growth forecast of 7% y-o-y.

On the demand side, the government expects the private sector to be the main engine of growth with an expansion of 9.6% y-o-y in 2022. These estimates are relatively challenging at a time when the economy is just about to be back on its feet. Should some of these headline growth expectations fall short of expectations, it will indirectly mean a higher budget deficit and debt to GDP ratio for Malaysia in 2022.

Danger signs everywhere

This column has previously argued that Malaysia has been experiencing a declining rate of tax revenue as a percentage of GDP and based on the Budget 2022 presentation, it can be seen that this will deteriorate further to 10.7% this year and to just 10.5% next year. This is despite the government’s forecast that tax revenue in absolute terms will increase by 4.8% this year to RM161.8bil and a further rise of 5.9% next year to RM171.4bil. Inclusive of non-tax revenue, Malaysia’s projected revenue is barely sufficient to meet operating expenses as can be seen from the narrow surplus between 2018-2022 as shown in the table. With higher federal government debt, the Fiscal Outlook Report 2022 also showed a worrying and rising trend over the last few years on the country’s Debt Service Charge (DSC).

The DSC, which used to be well below 15%, is now expected to increase to 18.5% in 2022 from 17.8% this year and 15.4% in 2020. In absolute terms, our DSC has increased from about RM34.5bil to as high as RM43.1bil in just two years – a compounded average growth rate (CAGR) of 11.8%. Clearly, this is not sustainable and Malaysia needs to address its fetish for debt to sustain growth and development. As a percentage of direct taxes collected from individuals, DSC has increased from 88.6% to 114.9% and this means that from what used to be more than enough to pay the DSC, tax collection from individuals is now insufficient to pay for it.

Government’s bold Prosperity Tax

While no new taxes, well at least not permanent, the move to introduce a one-off Prosperity Tax of 33% or nine percentage points more than the current corporate tax rate of 24% to boost the government’s coffers appears to punish all large companies with chargeable income above RM100mil. This move is targeted towards some 234 companies that are presently enjoying profits above the threshold amount and are expected to generate some RM5bil in additional revenue to the government.

Before this, there have been calls for a windfall tax to be levied, and although the government had repeatedly said it has no intention to do so, the imposition of this Prosperity Tax appears to punish all large companies instead. However, the actual impact may differ. This is based on the fact that listed companies are mainly holding companies and the presented financial statements are effectively consolidated accounts of a particular holding company with many subsidiaries. Hence, the impact may be muted for certain industries where the practice of having a stand-alone company for a particular business or project is the norm, more so among property, plantation, or even certain manufacturers. Of course, the hardest hits would be the banks, despite having subsidiaries in other financial-related activities, most of them contribute more than RM100mil in chargeable income. Another point of contention is that although it is a one-off tax, it will have an impact on the amount of dividends these corporates pay to their shareholders, especially towards institutional shareholders like the Employees Provident Fund, the various funds under Permodalan Nasional Berhad, and other unit trust funds. This in turn reduces the asset managers’ ability to pay a good dividend, especially for the 2022/2023 financial period.

More expensive to trade on Bursa Malaysia

Under Budget 2022, one of the measures to raise government revenue is to increase the present stamp duty rate of 0.1% of contract value for trading of listed company shares to 0.15% and the abolishment of RM200 cap on the duties. While the increase from 0.1% to 0.15% may not hurt investors, clearly the removal of the RM200 cap is unwelcome as it will increase the cost of trading on Bursa Malaysia for market participants who trade shares in larger contracts sums. The trigger point is now at RM133,333 in contract value whereby anything more than this amount, an investor will pay more in stamp duty than before. This will make trading on Bursa Malaysia more expensive and block trades and large trades in the market itself can be costly. For example, buying 1 million shares of Maybank at RM8.20 per share will result in total stamp duty of RM12,300 instead of RM200, an increase of 6,050%! For some investors, the stamp duty is even more than brokerage fees as for institution trades it is common to see a brokerage rate of just 10 basis points. At a time where exchanges are finding ways to reduce the cost of trading, Malaysia’s move to raise stamp duty and at the same time remove the cap of RM200 per trade is seen as detrimental to the market.

At the same time, the government has also removed the Sales and Service Tax of 6% that is imposed on the brokerage fee that is paid. However, this move was not necessary when the removal of the cap is clearly much more damaging to investors’ trading activities. For some, this is a form of capital gains tax (CGT), but surely, one can’t be paying a CGT when buying shares listed on the local bourse. In addition, with the higher stamp duty, and assuming the local bourse continues to see robust trading of at least RM60bil a month, this stamp duty alone can raise as much as RM2.16bil to the government’s coffer.

Big on development expenditure

Unlike past budgets, Budget 2022 seems to have forgotten that the construction sector exists as there was no specifically allocated amount for any large infrastructure project. Nevertheless, this is not entirely surprising as the government is formulating a new funding strategy when it comes to infrastructure-related projects under the Public-Private-Partnership 3.0 model. Interestingly, of the RM75.6bil that is provided for, some 88% are targeted towards 6,755 ongoing and new projects. The transport sector takes the lion’s share of RM15.5bil while the education and health sector’s shares are RM12.0bil and RM4.5bil respectively.

A missed opportunity

This column has previously highlighted that the government ought to table a budget with a proper medium to long-term tax strategy to raise the government’s revenue. Again the opportunity presented to the Minister was not made use of on Budget Day. Instead, under the Fiscal Outlook Report 2022, the government is formulating a revenue framework, namely the Medium-Term Revenue Strategy (MTRS), that will adopt international best practices in modernising Malaysia’s tax system and administration. On tax policy, the government is looking at ways to reduce the reliance on direct taxes and widen the revenue base by shifting to consumption-based tax and reducing the dependence on petroleum-related revenue. As MTRS is still work-in-progress, a report is expected to be ready next year and this is likely to be endorsed by the government.

The nation eagerly awaits the road map towards greater and more holistic tax measures that will enable Malaysians to prepare themselves for the inevitable and to make efforts to correct both the income and wealth inequalities that we see today in our society. At this stage, the nation does not have a choice but to embrace higher taxes going forward. Failure is not an option.

Pankaj C. Kumar is a long-time investment analyst. The views expressed here are his own.

Click here to read the summary of the National Budget 2022.

5.0

5.0