The Malaysia Budget 2021

Themed “Resilient as One, Together We Triumph” (Teguh Kita, Menang Bersama), the Malaysian Budget 2021 was announced on 6 November 2020. Full speech of the Minister of Finance is available here.

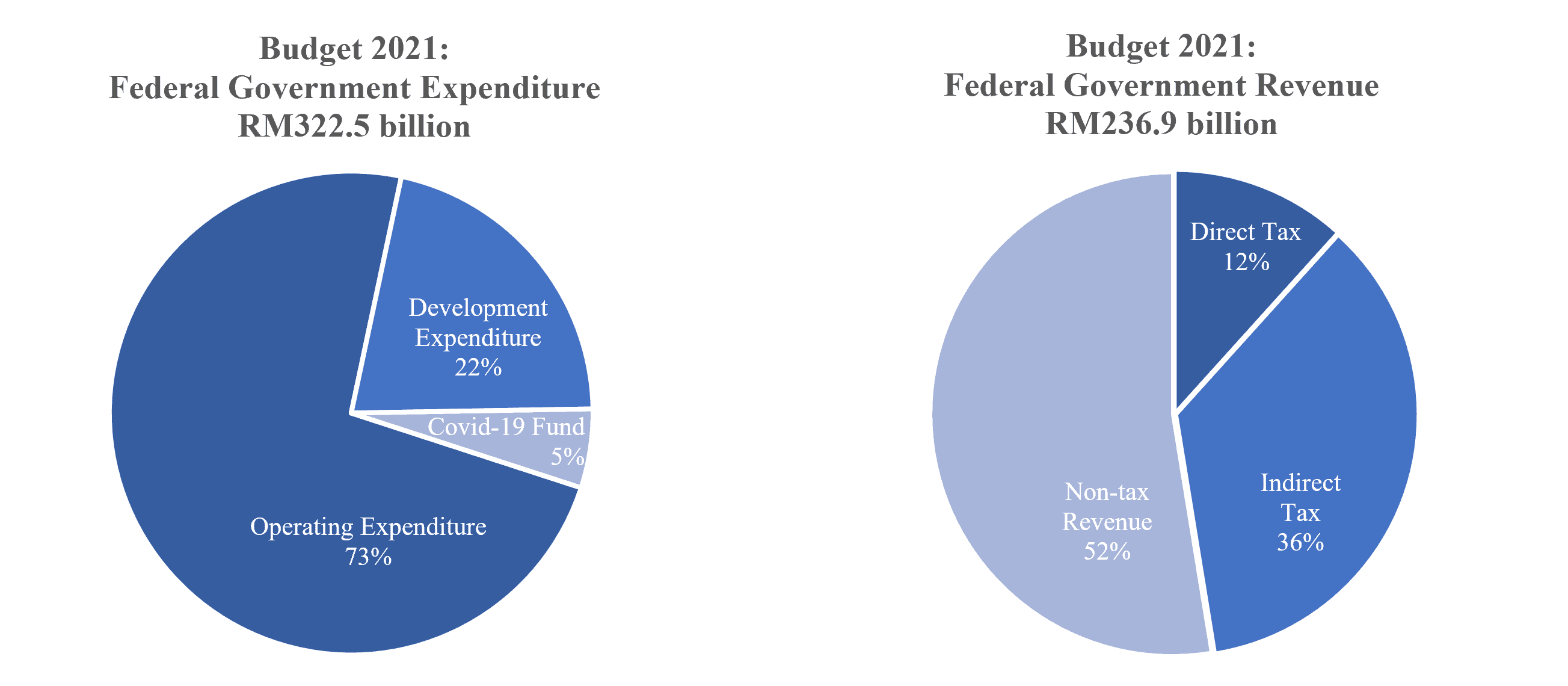

The proposed Budget 2021 is a continuation from the PRIHATIN, PRIHATIN SME PLUS, PENJANA and KITA PRIHATIN stimulus packages. This budget is the largest expenditure in history with a value of RM322.5 billion – with higher Government spending, selective tax reliefs and breaks and targeted incentives to support private domestic demand. From the amount allocated, RM236.5 billion is for operating expenditure, RM69 billion for the national development and RM17 billion for the COVID-19 Fund. The Government revenue collection for the year 2021 is expected to come from direct tax (RM131.9 billion), indirect tax (RM42.5 billion) and non-tax revenue (RM62.5billion). The Government do not introduce any form of new taxes as taxpayers are still grappling with the impact of the pandemic.

Key proposed allocations

- 5 billion for Bantuan Prihatin Rakyat (BPR)

- RM 7.4 billion to build and upgrade digital infrastructure

- RM 4.6 billion for Bumiputra entrepreneur’s empowerment

- RM 3.8 billion on transportation infrastructure development

- RM 2 billion for PENJANA Kerjaya

- RM 2 billion on Green Technology Financing Scheme 3.0 (GTF3.0)

- RM 1.5 billion for targeted wage subsidy

- RM 1.5 billion for Jaringan Prihatin Programme

RM 1 billion investment incentives package for high value-added technology

Key Highlights

| Personal | Corporate |

|---|---|

|

|

More detailed Budget 2021 Summary

- PwC- Centre Stage: Budget 2021 Overview

- PwC – TaXavvy Budget 2021 Edition (Part 1)

- PwC – TaXavvy Budget 2021 Edition (Part 2)

- PwC – 2020/2021 Malaysian Tax Booklet

- KPMG – 2021 Budget Snapshots

- EY – Malaysia Budget 2021: Tax snapshots

- EY – Take 5 – Malaysia Budget 2021

- Deloitte – Tax Espresso (Special Edition): Highlights of Budget 2021 (Part 1)

Budget commentaries

ICDM Post-Budget PowerTalk | Wednesday, 18 November 2020 | 2.00pm – 3.30pm | Virtual

At this session, we will be exploring

- A snapshot of the Budget

- Top 3 corporate tax proposals that every Board member should know

- Key personal tax issues that could have an impact on Board members in their individual capacity

Watch recording here.

Photo by Pedro Lastra on Unsplash.

1.0

1.0