Bookended by a global health emergency and a contentious US election, with a new era of social unrest erupting in between, 2020 has brought rapid change and historic disruption to all areas of the economy and life in general. Corporate boardrooms felt the impact as well.

Our 2020 Annual Corporate Directors Survey highlights some ways directors are rising to the moment. From facing areas that institutional shareholders have emphasized in recent years, like environmental, social, and governance (ESG) issues and shareholder engagement, to tackling company culture and thinking more broadly about issues like company strategy and executive compensation, the crisis presents opportunities that many directors are embracing.

But stubborn challenges remain. Directors still express dissatisfaction with their fellow board members, struggle to maintain the balance between collegiality and vigorous debate, and see little board refreshment. And even while making some improvements in boardroom diversity, directors aren’t always convinced of how important that diversity really is. While this crisis presents new opportunities for change, the onus remains on directors to make the most of these times.

Key findings from corporate directors

On shaky ground—overseeing crisis from the boardroom

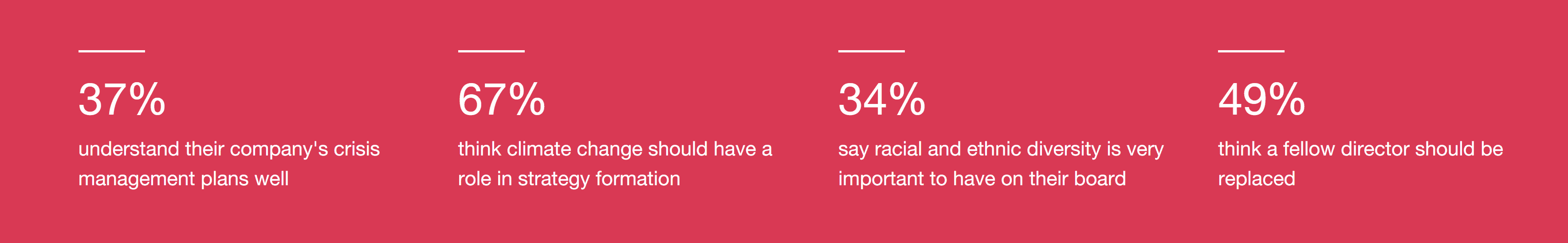

As the world faces a global public health crisis and its economic fallout, only 37% of directors said their board fully understands their company’s crisis management plan. While boards give management high marks for their pandemic response, directors need to ensure that positive outlook isn’t masking potential blind spots. Boards should take the time to revisit crisis plans and revise in light of what worked—and what didn’t.

Boards make progress on ESG—but there’s still work to be done

Compared to 2019, directors are much more likely to say that ESG issues are part of the board’s agenda (45%, up from 34%). Director sentiment and perceived impact diverge, however: 51% of directors say their board fully understands ESG issues impacting the company, but only 38% think those issues actually have a financial impact on the company.

Institutional shareholders continue to emphasize the importance of long-term, sustainable business models, lobbying strongly for the disclosure of ESG metrics. As the pandemic drags on and companies face financial pressures, 2020 may prove to be the tipping point to broaden the boardroom’s strategic view, including a meaningful response to ESG issues.

Supporting diversity—in theory

More than four out of five directors (84%) agree that companies should be doing more to promote gender and racial diversity in the workplace. But as the national conversation on racial justice has heated up, board efforts on racial and ethnic diversity lag, with only 34% of directors saying it is very important to have racial diversity on their board, and less than half of directors (47%) saying gender diversity is very important.

Now may be the right time to take a fresh look at the right targets to tie to executive pay. Only 39% of directors say diversity and inclusion objectives should be included in their company’s executive pay plans. Establishing board-level metrics to review regularly can help directors ground the discussion in data and know where the organization stands.

Next please! Directors want to see turnover, but boards aren’t planning for it

For the second year in a row, almost half of directors (49%) say at least one fellow board member should be replaced. Twenty-one percent say that two or more directors should go. But when it comes to succession planning, only about half of directors (49%) say a succession plan is shared with the full board. And 10% say their board doesn’t have any succession plan at all. Without a vision for their own future, it becomes that much more unrealistic to expect boards to effectively lead long-term change.

This article was first published here.

Download the full report at the right sidebar to read more.

Photo by Nastuh Abootalebi on Unsplash.

5.0

5.0