The COVID-19 pandemic has had a profound impact on businesses in Malaysia. Issues like falling consumer confidence, job loss and supply chain disruption have occupied not just the news, but also the consciousness of business executives and the public.

What does all this mean for trust in business?

We believe that businesses can and should measure and proactively manage their trust levels in authentic ways. Up until now, our studies on trust as well as The Building Trust Awards have been focused on companies with large market capitalisation. In an attempt to widen the trust conversation, we’re expanding our focus to look at trust in the context of medium-sized public companies in Malaysia in times of crisis.

Using our proprietary trust analytics framework, we’ve set out on a journey to find out:

- How medium-sized public companies in Malaysia build trust with their stakeholders in difficult times

- What factors drive the level of trust in these companies

- What businesses can do to shape their trust narrative during times of crisis

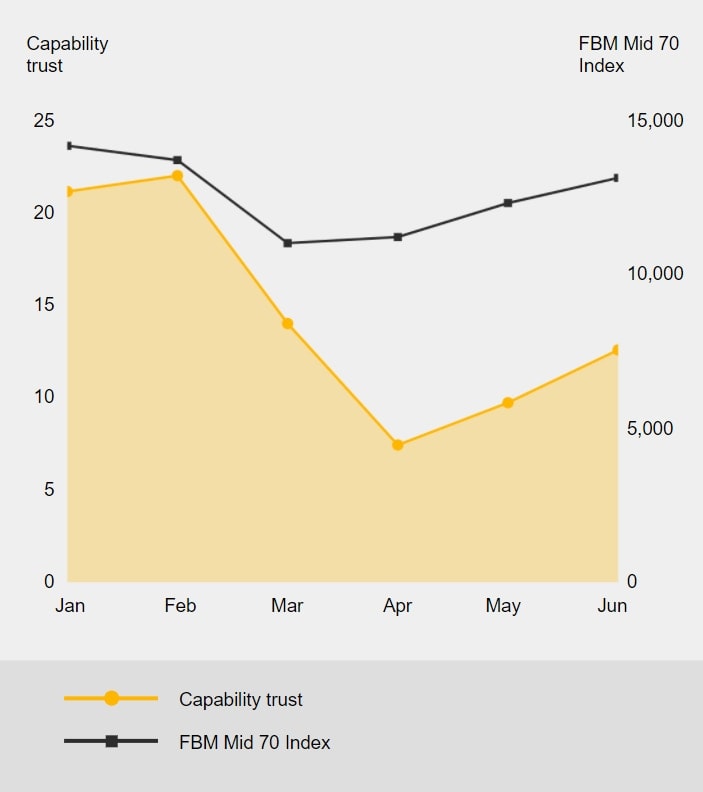

This report summarises key learning points from our study of the FTSE Bursa Malaysia (FBM) Mid 70 Index companies based on data collected between January and June 2020.

What COVID-19 has taught us about trust in business in Malaysia

Agility and customer-centricity drive capability trust

Companies with high capability trust in our study show great agility and put a strong focus on their customers when the crisis hit.

The strong positive correlation between capability trust scores and market performance suggests that these traits have the potential to move markets.

Building trust goes beyond paying lip service

Transparency in the context of building trust means more than providing information to your stakeholders. Companies that achieve a high transparency score during the first 6 months of 2020 also display honesty, fulfill their promises and prioritise health and safety.

CEOs must take the lead in engendering trust within the organisation through transparency. We offer four questions to kick-start the thinking.

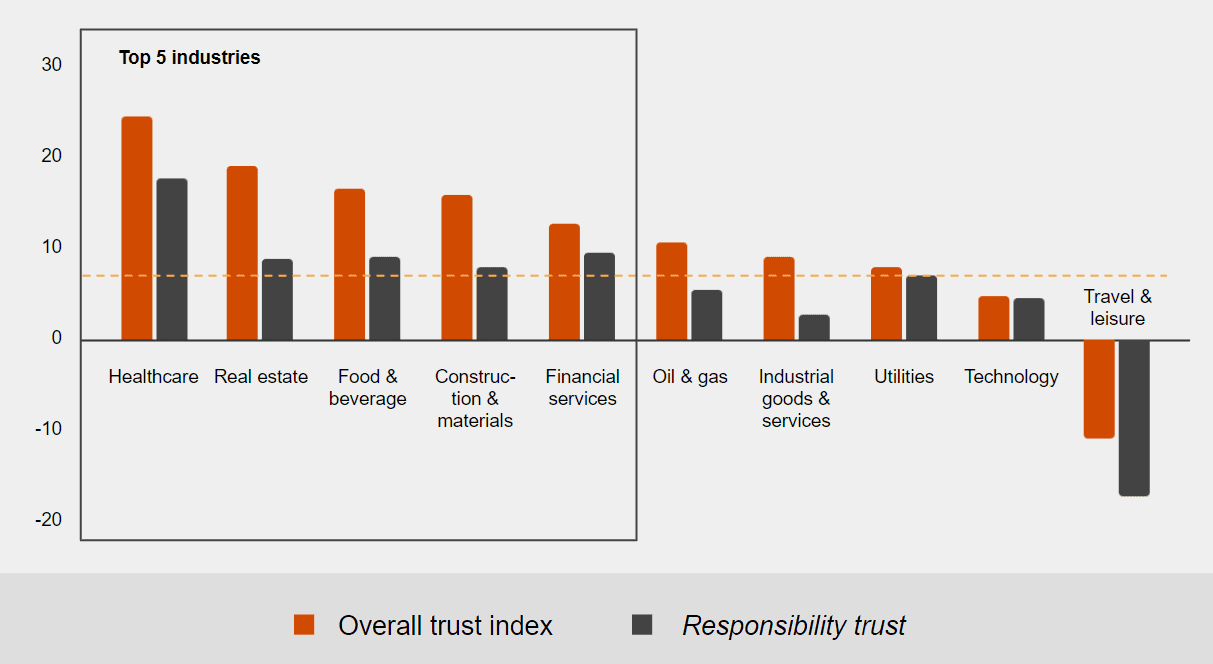

Responsible businesses win trust

The top five industries in our study have one thing in common: they also score highly in responsibility trust.

Healthcare companies lead the pack, while real estate companies hone in on trust amid uncertainties.

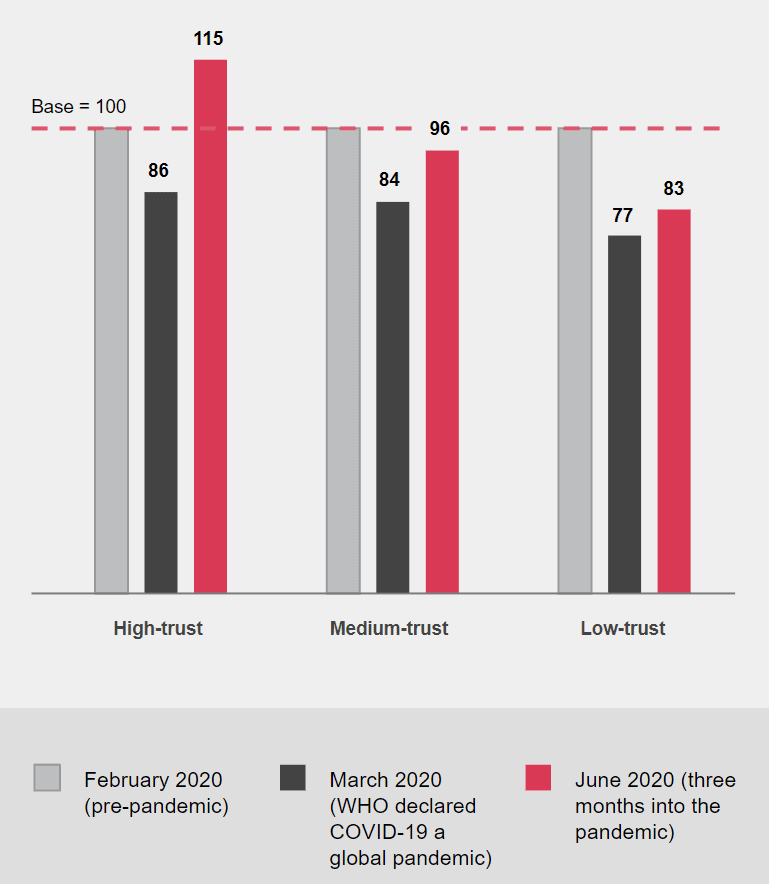

High-trust companies suffered smaller initial loss and rebounded quicker

High-trust companies in our study would lose 13.57% in value, collectively, in the month when WHO declared COVID-19 a global pandemic. And when June arrived, they recovered that initial loss and went on to gain 14.74% more than where they started in February.

Medium- and low-trust companies suffered greater initial losses and were slower to rebound.

This article was first published here.

Photo by Markus Winkler on Unsplash.

5.0

5.0