There’s no question that generative AI is one of the buzziest innovations of the last year. But with all the hype around generative AI (GenAI), it’s hard to parse what actions have leaders actually taken to implement the tech—and if that progress differs between industries, functions, and regions.

To find out, Russell Reynolds Associates surveyed over 2,500 leaders globally in September of 2023, learning that:

- Nearly three-quarters of leaders have taken steps towards embracing GenAI, but few have actually implemented it

- Leaders implementing GenAI are focusing more on evaluating its potential vs. adjusting talent strategies

- Organizational performance doesn’t have a strong bearing on GenAI implementation progress

- When it comes to GenAI implementation progress, the technology industry leads the way

- Strategy, technology, and go-to-market functions are most likely to have implemented GenAI, while finance and HR have been slower to embrace the technology

- Leaders in the Americas are slightly more likely to have taken action on GenAI

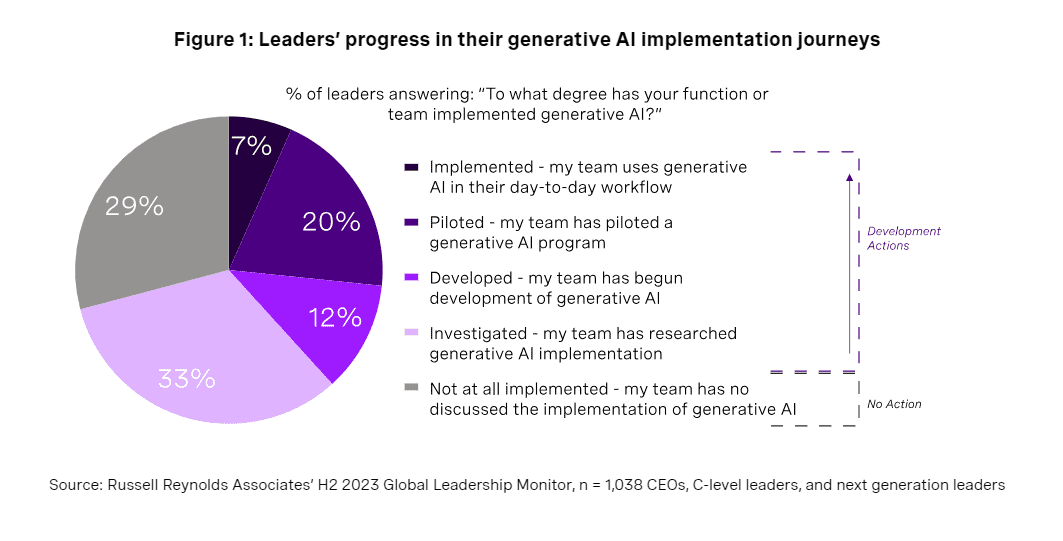

Nearly three-quarters of leaders have taken steps towards embracing GenAI, but actual implementation is low

Whether it’s part of a strategic plan or a reaction to current market buzz, the majority of leaders globally are making moves around GenAI, but few have actually implemented the tech. Nearly three-quarters (71%) have taken a step towards embracing GenAI in their function or team’s workflow. Conversely, 29% have taken no action (Figure 1).

Within the 71% of leaders who have taken action, 33% are in the initial investigation phase, making this the most common stage globally. A similar proportion of leaders (32%) are in the developing (12%) and piloting (20%) phases. Only 7% of leaders are using GenAI in their day-to-day workflows.

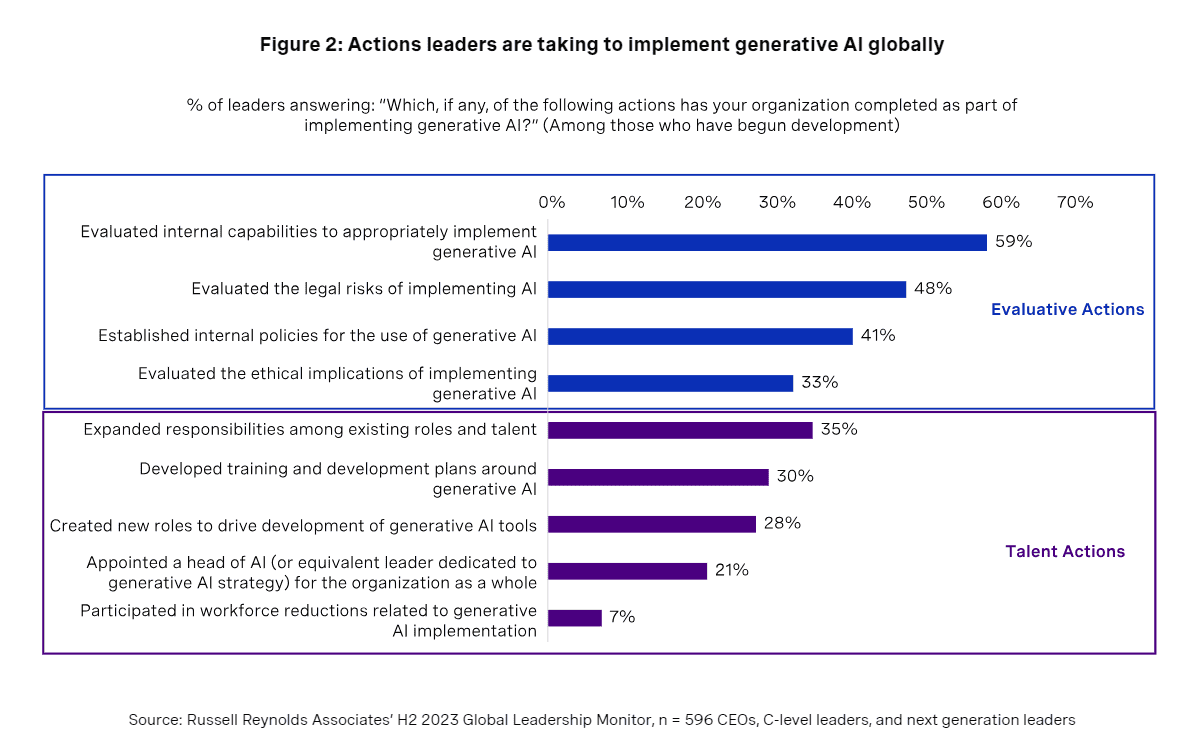

Leaders implementing GenAI are focusing more on evaluating its potential vs. adjusting talent strategies

Evaluating internal capabilities and potential legal risks have taken precedent over major talent interventions, like appointing a Head of AI or workforce reductions.

Nearly 60% of leaders say that they’ve evaluated internal capabilities, while nearly 50% report assessing the legal risks associated with implementing GenAI. Conversely, 21% have appointed a dedicated leader for the organization’s holistic AI strategy and just 7% say they’ve reduced their workforce (Figure 2).

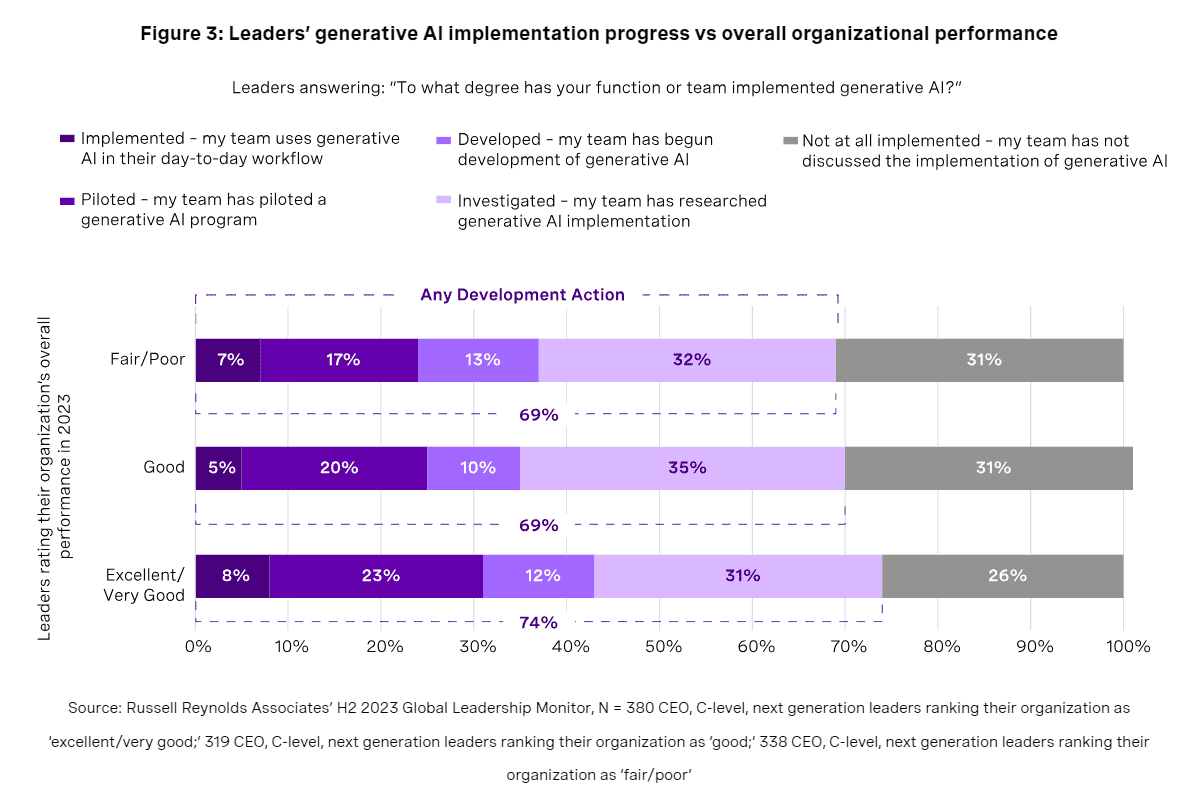

Organizational performance doesn’t have a strong bearing on GenAI implementation progress

When we compared how leaders rate their organization’s 2023 overall performance to their GenAI implementation progress, there were no notable differences between those with positive or negative business outlooks. This demonstrates how seriously leaders are taking GenAI’s future impact.

Via our Monitor, we know that 72% of all leaders agree that a strong understanding of GenAI will be a required skill for future C-suite leaders. It’s telling that—even for leaders who view their organization’s performance negatively—implementing GenAI is a priority.

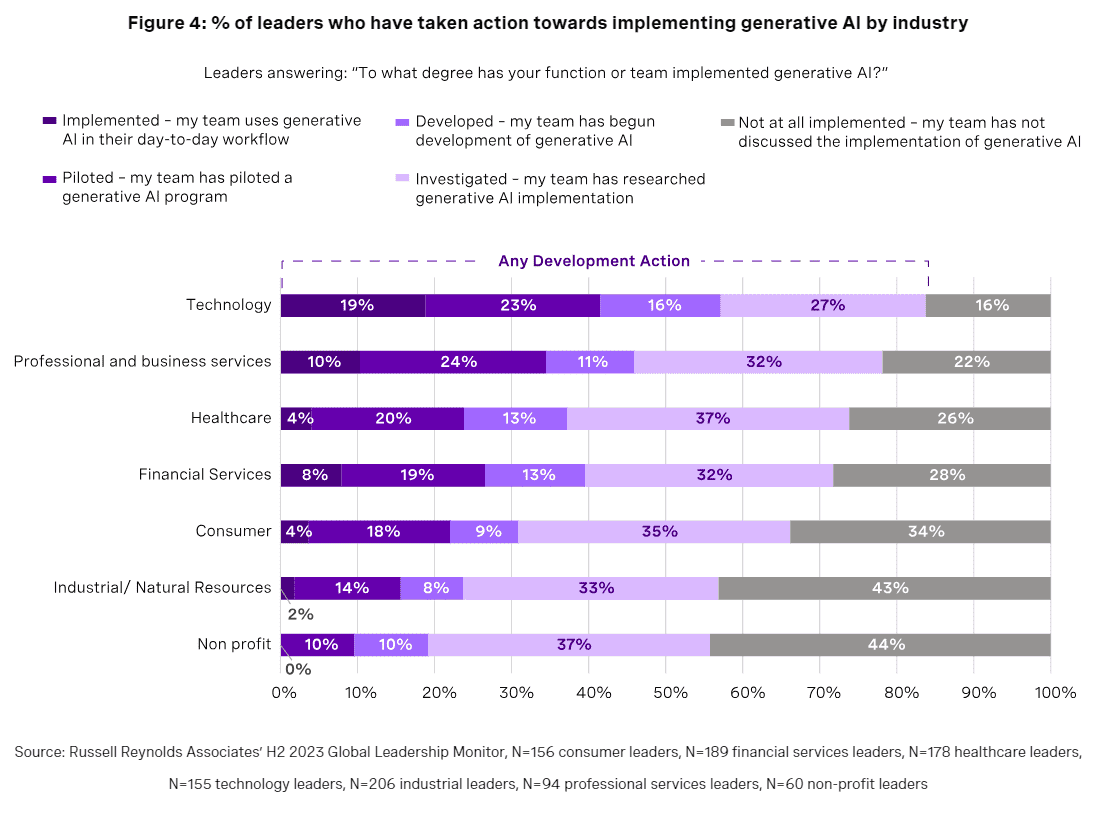

When it comes to GenAI implementation progress, the technology industry leads the way

Perhaps unsurprisingly, organizations in the tech industry are most likely to engage with GenAI, with 84% of tech leaders reporting having taken at least one step towards embracing the technology, and 19% using it in their day-to-day workflows (Figure 4). Professional services organizations have also made significant progress, with 10% of leaders saying they’re using GenAI day-to-day. These organizations are using AI to deliver faster client communications, automate processes, and analyze data.

The healthcare industry has also taken significant steps towards implementing GenAI, with 20% of organizations piloting GenAI programs and 4% using it in their daily workflows. Healthcare and healthtech leaders are using these tools to improve clinical decision-making, increase diagnosis comprehension, and simplify claims submissions. In fact, the first drug to be discovered by AI began late stage trials in November 2023.

Financial services leaders have also begun making moves around GenAI, with 8% already using it in their day-to-day, and 32% in the piloting or developing phases. Major players like JPMorgan and Citigroup report using AI for fraud detection and risk assessment, and plan to eventually use these tools to help clients personalize investments, calculate credit scores, and optimize portfolios. The majority of consumer industry has also taken steps to implement, using GenAI to manage customer analytics and engagement, data governance, and optimize content.

The non-profit and industrial & natural resources industries are least likely to have responded to GenAI, as 44% and 43% of these leaders report taking no action, respectively (Figure 4). This is likely due to a lack of financial resourcing and/or difficulties drawing tech talent to these industries. Still, both are investigating GenAI, with 10% of non-profit and 14% of industrial organizations piloting programs.

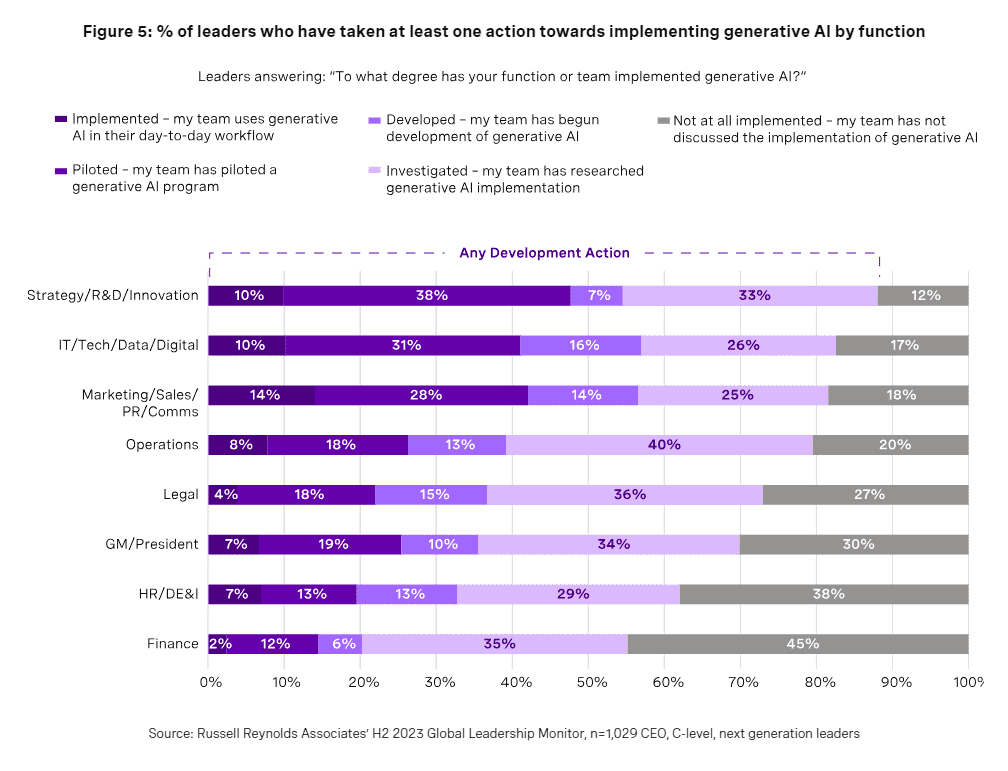

Strategy, technology, and go-to-market functions are most likely to have implemented generative AI, while finance and HR lag behind

From a functional perspective, strategy/R&D/innovation leaders are farthest along in their GenAI implementation journey, with over half reporting that they’re piloting (38%) or have fully implemented (10%) the technology in their day-to-day workflow (Figure 5).

Tech, data, and digital leaders, as well as marketing, sales, PR, and communications leaders have also made significant moves, with 41% and 42% reporting that they’re piloting or have fully implemented GenAI.

Leaders in finance and HR and DE&I functions were the least likely to report that their teams had taken steps to implement the technology, with 45% and 38% saying they’ve taken no action. Given the risks these leaders have to contend with, these gaps make sense. For example, HR leaders who are handling employee data need to be thoughtful around issues of equity and privacy before engaging with AI.

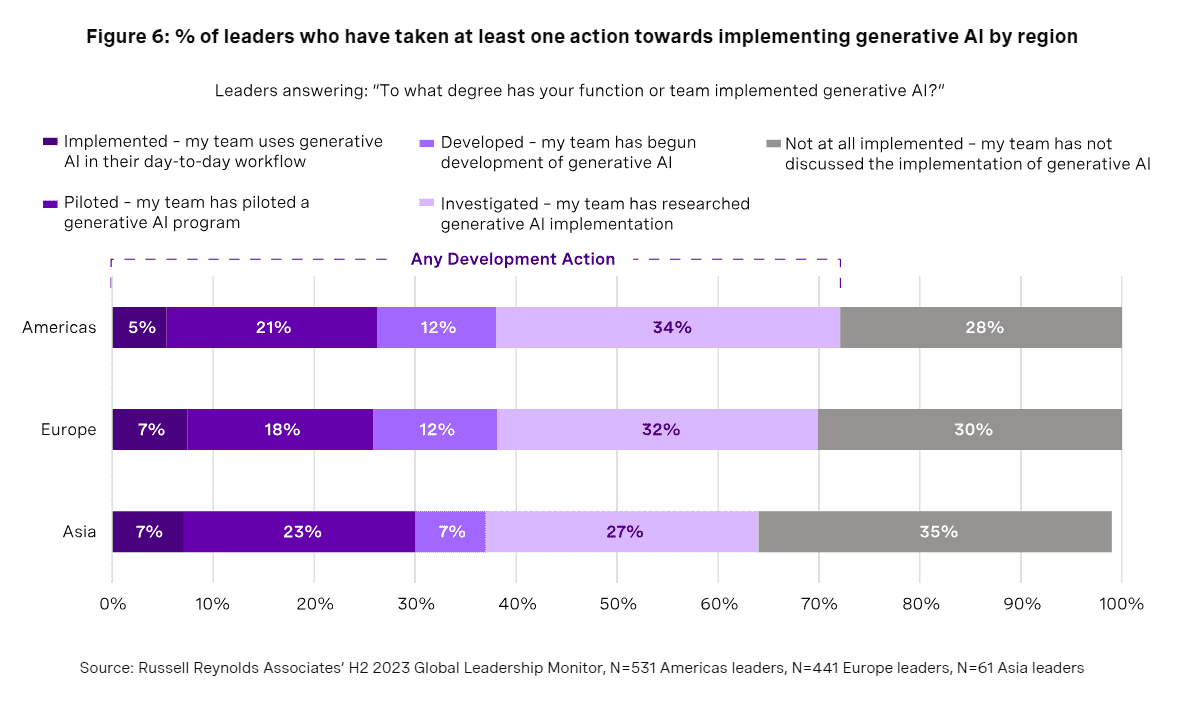

Leaders in the Americas are slightly more likely to have taken action on GenAI

Nearly three-quarters (72%) of leaders in the Americas have taken steps towards implementing GenAI. European leaders are a close second, at 70%. Leaders in Asia aren’t far behind, with 65% agreeing that they’ve taken at least one development action (Figure 6). From a maturity perspective, the regions are fairly balanced in their implementation progress, with a quarter of leaders in the Americas and Europe and 30% of leaders in Asia reporting having piloted or fully implemented GenAI.

Barriers to GenAI implementation

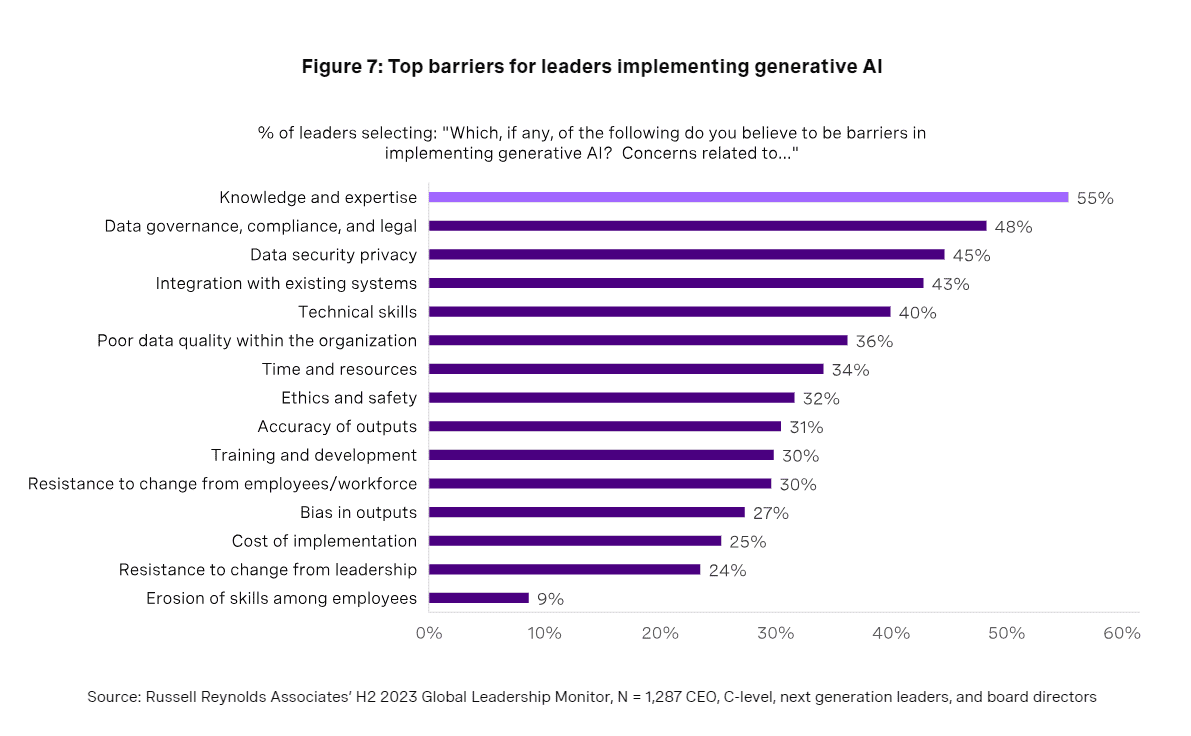

Given the technology’s relative newness, GenAI’s current adoption rate is astounding. However, while 71% of leaders have taken steps to bring the technology into their team’s workflow, we found that only 32% are confident in their own skills around said implementation.

This is compounded by the fact that 55% of leaders name “knowledge and expertise” as a barrier to implementing GenAI, making it our most selected concern.

What’s next for leaders developing GenAI implementation strategies?

Regardless of where you are in your GenAI journey, it’s clear that we’re at an inflection point. Despite some significant gaps, the speed with which organizations have moved to implement GenAI speaks to the pervasiveness of this new technology. While there is no way to currently predict what AI’s long term implications for the workforce will be, understanding the steps organizations have taken today helps leaders better plan for the world of tomorrow.

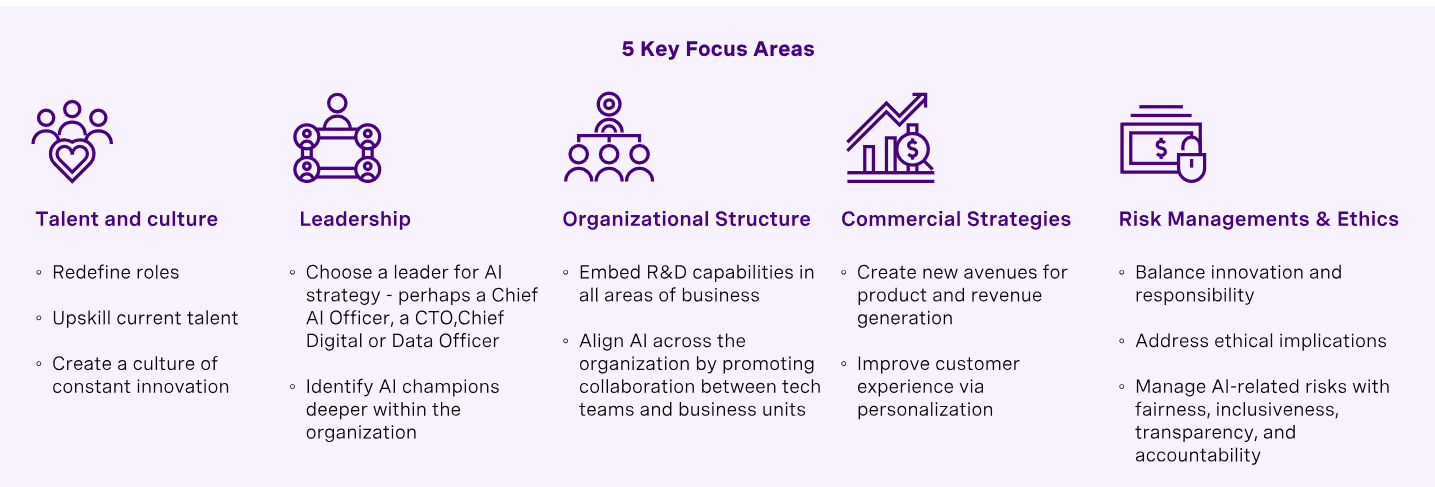

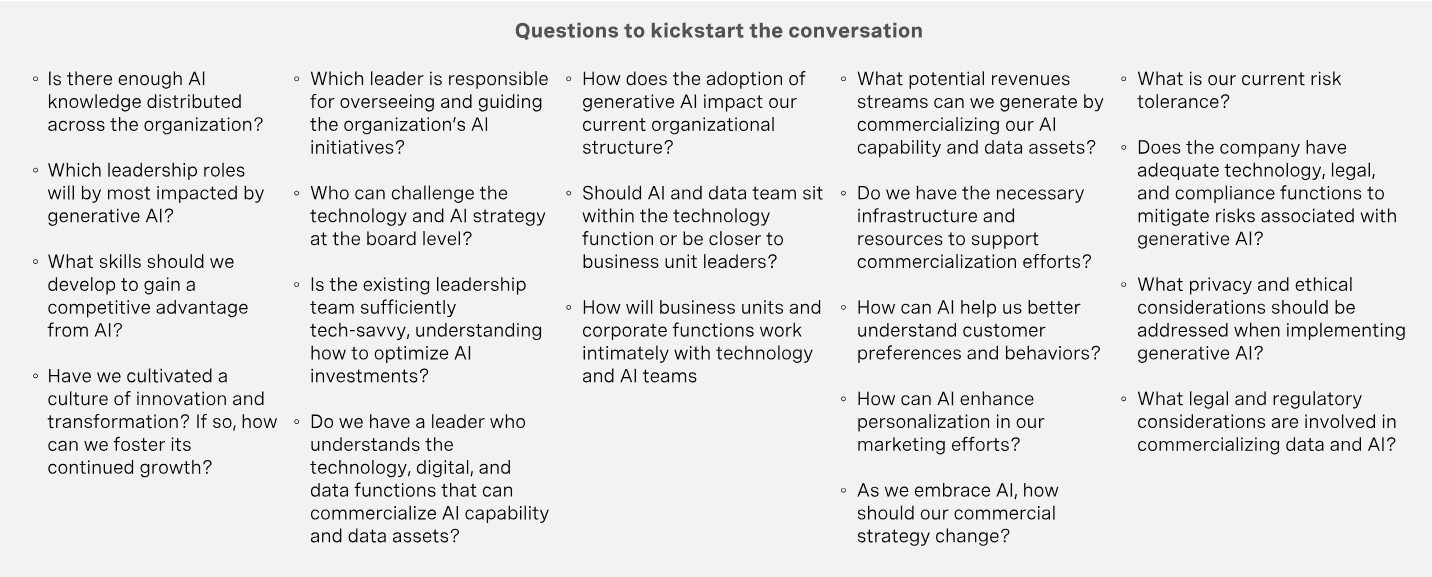

To seize these opportunities, we identified five key areas to help CEOs, boards, and senior technology leaders navigate GenAI’s impact on their organizations, as well as questions they can use to structure conversations around their implementation strategy.

Authors

- Fawad Bajwa co-leads Russell Reynolds Associates’ AI, Analytics & Data Practice globally. He is based in Toronto and New York.

- Leah Christianson is a member of Russell Reynolds Associates’ Center for Leadership Insight. She is based in San Francisco.

- Jemi Crookes leads Russell Reynolds Associates’ Technology Knowledge team. She is based in Washington D.C.

- Tom Handcock leads Russell Reynolds Associates’ Center for Leadership Insight. He is based in London.

- George Head leads Russell Reynolds Associates’ Technology Officers Knowledge team. He is based in London.

- Tristan Jervis leads Russell Reynolds Associates’ Technology practice. He is based in London.

- Tuck Rickards is a senior member and former leader of Russell Reynolds Associates’ Technology practice. He is based in San Francisco.

The authors wish to thank the 2,500+ leaders from RRA’s global network who completed the 2023 Global Leadership Monitor Fall Pulse. Their responses to the survey have contributed greatly to our understanding of leadership in 2024 and beyond.

5.0

5.0