Cryptocurrencies have been gripping investors’ attention in recent years, particularly since late 2020. In November 2020, Bitcoin, the largest cryptocurrency by market value, crossed US$68,000. That was some 19 times the low of mid US$3,500 in 2019. For those who have purchased Bitcoins in 2019 and even in 2020, they would have made handsome profits. But, investing in cryptocurrencies, including the major ones like Bitcoin and Ethereum, carries substantial risks. First is the marked price volatility. Investors must have the capacity to stomach large fluctuations in prices. Taking Bitcoin as an example, prices could change by up to 30% intraday, as evidenced in May 11, 2019 (intraday high of +26.7%) and March 12, 2020 (intraday low of -31.6%). Hence, the timing of purchases and sales will be crucial. Second, it should be noted that cryptocurrencies are not backed by underlying assets. The value of cryptocurrencies is essentially determined by the belief of holders and investors who think that the currencies will be worth more in future. Should that belief change in a negative way, the price of cryptocurrencies will plunge.

Many believe that investing in the stock market will remain relevant despite the emergence of cryptocurrency which an increasing number of investors is accepting as a new asset class. Through investing in a stock, you are seeking to diversify and grow your wealth by buying part ownership in a business without having to start your own business. If an investor has done proper research and chooses the right stocks, it is possible to obtain decent returns without taking unnecessary high risks. Investors should focus on identifying fundamentally healthy companies with low valuations, low leverage, high growth, robust management and strong track record. These are companies that possess the capacity and momentum to grow, and will see better value preservation should adverse events strike.

Lately, there has been much debate on how certain sectors of thematic investing, namely Shariah and/ or ESG stocks, are better than conventional ones. This is not necessarily the case, as Shariah stocks outperformed the conventional stocks during the 2008 Global Financial Crisis by a large margin due to prohibition of investing in bank stocks in Islamic portfolios, and it was bank stocks that were hit hard during the Global Financial Crisis. Right after the said crisis, Islamic portfolios returned to their normal performance levels. As for investing in ESG stocks, it is the research and experience of the fund manager that dictates whether an ESG portfolio can outperform or not. It is also possible to lose money when investing into ESG stocks, especially if the stocks are overvalued or the companies are in a declining sector. At the end of the day, investors will need to look at both business growth and sustainable environmental, social, and governance practices in order to obtain their returns. Many certainly agree that investing in ESG companies is not likely to outperform at all times, but will benefit the society in the long run.

Many have said that “An active fund manager cannot outperform ETFs or IndexTracking Funds”; and while this is true for some fund managers (as even Warren Buffet has underperformed at times), it is completely wrong to generalise all active fund managers in this way. A good fund manager will be able to outperform the index (perhaps not always, but certainly most of the time), as the stock universe he or she selects from is larger and there are bound to be companies that show growth despite adverse economic conditions.

About The Writer

Dr. Tan Chong Koay has been in the fund management industry for more than 45 years. He is a Chartered Fellow of Chartered Management Institute (UK), Fellow of the Institute of Financial Accountants (UK) and Fellow of Institute of Public Accountants (Melbourne, Australia). He is also the founder & Chief Strategist of Pheim Asset Management Sdn Bhd, Malaysia and Pheim Asset Management (Asia) Pte Ltd, Singapore.

By applying his original and proven investment philosophy of ” never fully invest at all times”, he has successfully weathered through many major crises and navigate the volatile Asian/ASEAN markets, establishing consistent and outstanding long-term track records in the process.

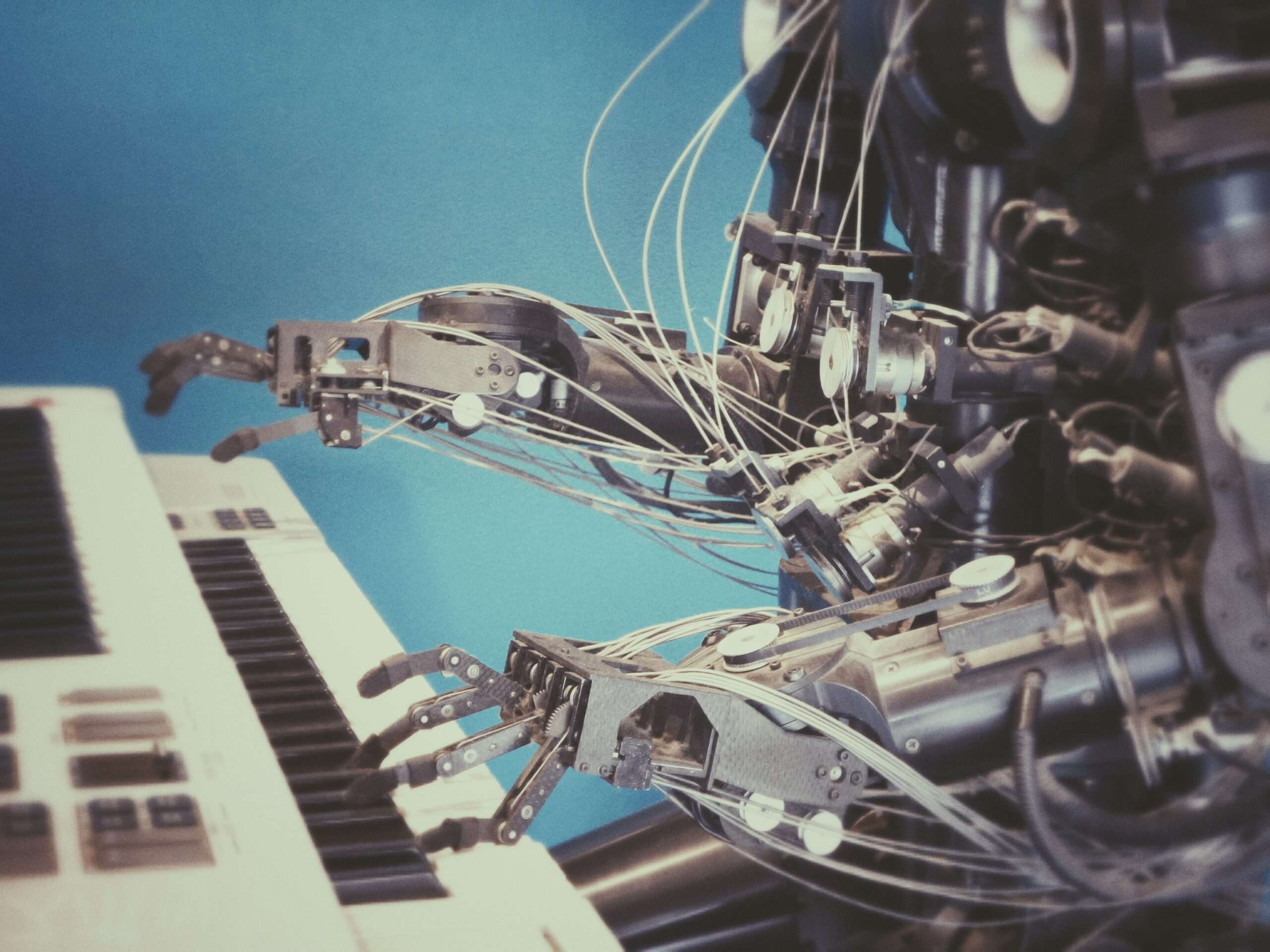

Photo by Kanchanara on Unsplash.

5.0

5.0