Asia-Pacific boards prioritize economic conditions amidst volatility. Longer-term priorities such as climate change, should be accelerated.

In brief

- Asia is still buoyant, but economic and geopolitical headwinds loom.

- Most boards acknowledge their operating models may be unfit for purpose in five years.

- Boards must ensure their mindset, governance, operations and supply chain are fit for the changing marketplace.

Asia-Pacific business remains buoyant but boards must evolve — and act fast — to counter looming global pressures.

The region is expected to account for nearly 60% of global GDP growth in 2024, surpassing the pre-pandemic average. This follows a strong year for most national economies, with almost three-quarters of Asia-Pacific CEOs predicting higher revenue growth and profitability than the year before.

The region is, however, being buffeted by the “stabilized volatility” gripping the world economy. And geopolitical tensions, inflation and rising labor costs are key concerns for Asia-Pacific board directors, the latest EY Asia-Pacific Board Priorities survey shows.

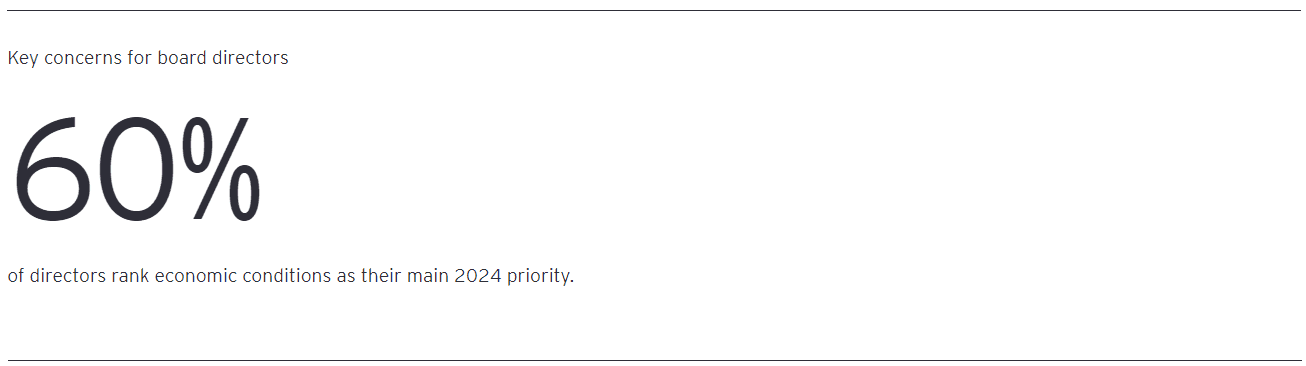

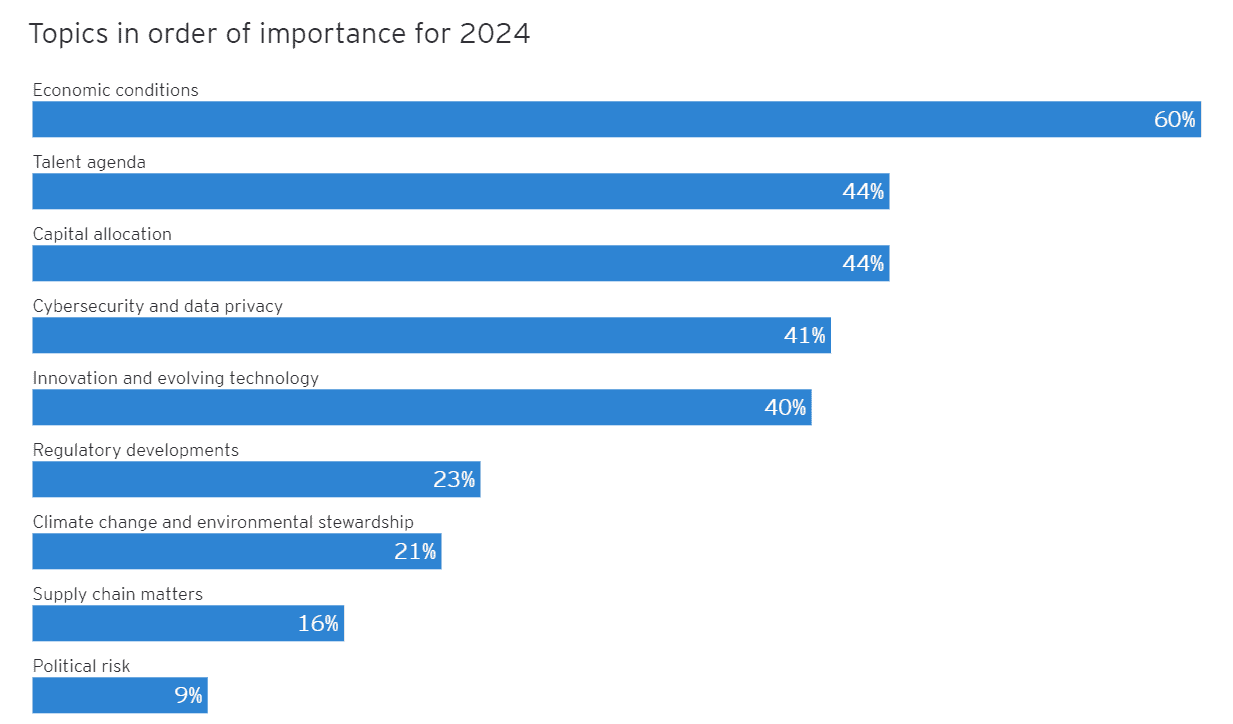

The economy is by far the most important issue for 60% of directors, at a time when cross-border regulation — particularly around environmental, social, and corporate governance (ESG) — could constrain growth. After economic conditions, Asia-Pacific boardrooms worry most about capital allocation and talent shortages.

Only 21% of respondents cite climate change as a priority, despite extreme weather being the greatest risk in the 2024 WEF Global Risks Report. But political risk comes even lower in our survey, at just 9%. This is despite 2024 elections — in nations representing more than half (54%) of the global population and 60% of GDP — with potentially significant implications for industrial strategies, climate policies and conflicts around the world.

The survey also uncovered some significant differences between boards in Australia, Japan and Korea. While boards in all three countries ranked economic conditions as paramount, they differed on topics such as cybersecurity and data privacy, innovation and evolving technology, and regulatory developments. Boards in Australia, for example, were less likely to emphasize climate change and regulatory developments as topics that required more attention. Japanese boards, conversely, believe they could spend more time discussing climate change and political risk. They were also interested in delving deeper into regulatory developments and supply chain issues. Larger organizations (revenue above US$5b) are more likely to prioritize climate, more than smaller businesses (47% versus compared to 13% for smaller organizations) — as they are likely to be impacted by impending regulation on emissions reduction and associated disclosures.

EY’s annual Asia-Pacific Board Priorities survey had 174 responses from board directors in Australia, Japan and Korea, with supporting qualitative interviews with business leaders in mainland China and the Philippines. This report does not feature commentary on India, which falls within EY’s EMEIA region.

Chapter 1: Boards Adapt to Global Uncertainty

Geopolitical tensions threaten to continue generating headwinds for the global economy.

Mainland China, the world’s second largest economy, experienced slower growth in 2023 than many Asian economies, expanding by 5%. Economists therefore remained concerned about its ability to fuel regional growth in the short-to-medium term, due to reduced foreign direct investment and a housing market slowdown. In this environment, “Mainland China is deleveraging and a slowdown in its GDP growth will impact Asia and its financial and real economy markets,” says Mark Barnaba, EY senior fellow, Deputy Chairman Fortescue, ex-RBA Board Member.

“Mainland China is deleveraging and a slowdown in its GDP growth will impact Asia and its financial and real economy markets.”

Mark Barnaba – EY senior fellow, Deputy Chairman Fortescue, ex-RBA Board Member

Geopolitically, the escalation of conflicts in Europe and the Middle East could fracture international stability, potentially causing business unpredictability, oil price rises and reduced economic activity. Barnaba adds, “The global power equilibrium, both from a hard and soft power perspective will continue to evolve and boards will need to be more agile and globally networked.”

“The global power equilibrium, both from a hard and soft power perspective, will continue to evolve and boards will need to be more agile and globally networked.”

Mark Barnaba – EY senior fellow, Deputy Chairman Fortescue, ex-RBA Board Member

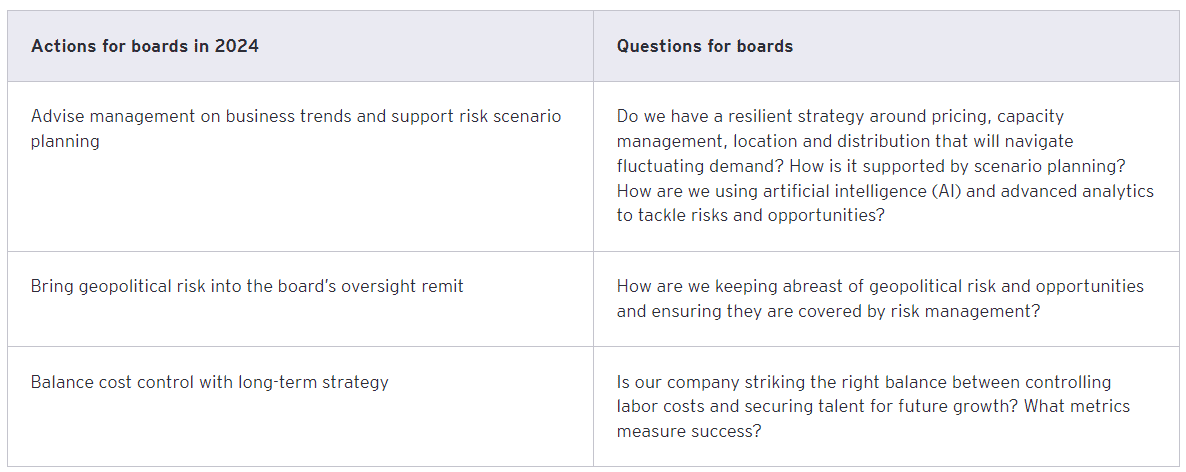

Boards should scrutinize the potential impact of geopolitical upheaval on their operating model and supply chain, and ensure management has appropriate frameworks to manage key risks, such as expanding nearshoring operations.

Many organizations are revamping their supply chains to avoid potential issues in the future. For example, Philip Leung, EY Greater China Markets Managing Partner (retired), board director of multiple Chinese state and privately owned companies listed on stock exchanges in Shanghai, New York and Hong Kong says that “some organizations in mainland China aim to de-risk their supply chains to avoid potential trade barriers — moving a portion of manufacturing to countries where they sell products, such as the EU.”

Geopolitically, the escalation of conflicts in Europe and the Middle East could fracture international stability, potentially causing business unpredictability, oil price rises and reduced economic activity. Barnaba adds, “The global power equilibrium, both from a hard and soft power perspective will continue to evolve and boards will need to be more agile and globally networked.”

“Some organizations in mainland China aim to de-risk their supply chains to avoid potential trade barriers — moving a portion of manufacturing to countries where they sell products, such as the EU.”

Philip Leung – EY Greater China Markets Managing Partner (retired), board director of multiple Chinese state and privately owned companies listed on stock exchanges in Shanghai, New York and Hong Kong

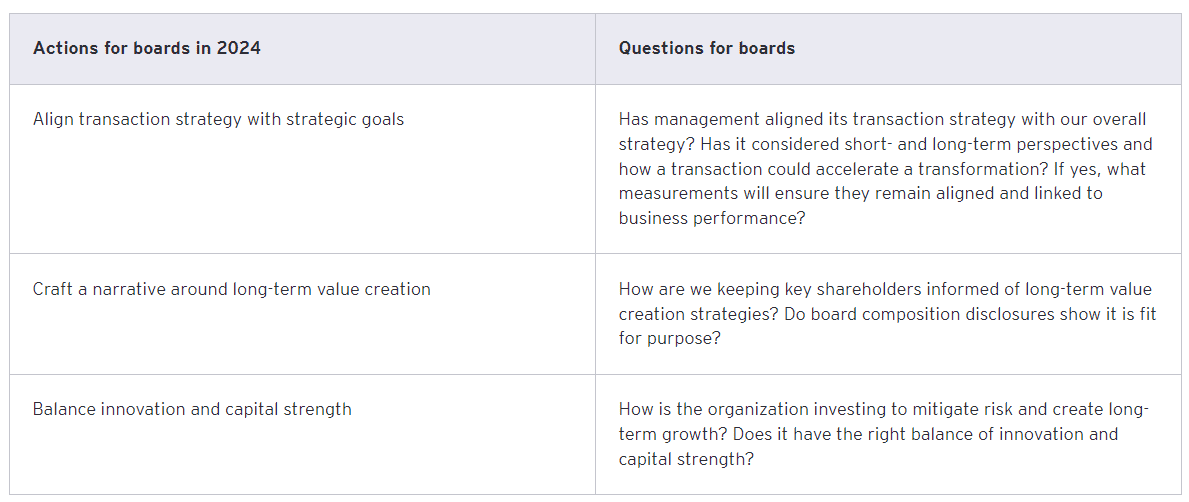

Chapter 2: Capital Allocation Pressures Renew Financial Discipline

Boards focus on capital allocation and financial discipline in the face of scarce, costly capital.

Organizations are moving their focus from growth to financial discipline as inflation, rising costs and diminished pricing power bite the bottom line. Capital allocation (equal to the talent agenda – see next chapter) is the second key focus area for directors, with two-thirds concerned about capital availability and 56% concerned with M&A, restructuring and divestments.

In economies where capital cost is lower, such as mainland China, boards will need to balance demand for dividend outflows to parent organizations against higher returns.

On the upside, Asia-Pacific looks set to continue to attract global capital that will drive economic growth and innovation region-wide.

Overall, board directors are satisfied that they spend sufficient time in this area. Looking at country differences, 57% of directors for Korean organizations ranked capital allocation as a key topic, more than Australia and Japan. The two key focus areas for directors in Korea are capital availability and R&D, and strategic investments.

Asia’s opportunities as the next green economy

Asia is a major supplier of products for the global green economy. Taiwan, for example, supplies nearly 60% of the world’s semi-conductors and an even larger share of advanced microchips.

Overall, boards are encouraging their organizations to adapt to this trend. Patrick Winter, EY Asia-Pacific Area Managing Partner says “Boards and executives have all the information they need, and the imperative, to start planning how they will adapt their business models to thrive in Asia’s green economy.”

Many regional governments are prioritizing access to low-cost energy. Current returns on clean power are around 6%, less than half that for upstream oil and gas. But, boards need to take a longer-term view to ensure future prosperity. Our 2023 EY Global Board Risk Survey echoes this: highly resilient boards sacrifice short-term financial performance for ESG.

“Boards and executives have all the information they need, and the imperative, to start planning how they will adapt their business models to thrive in Asia’s green economy.”

Patrick Winter – EY Asia-Pacific Area Managing Partner

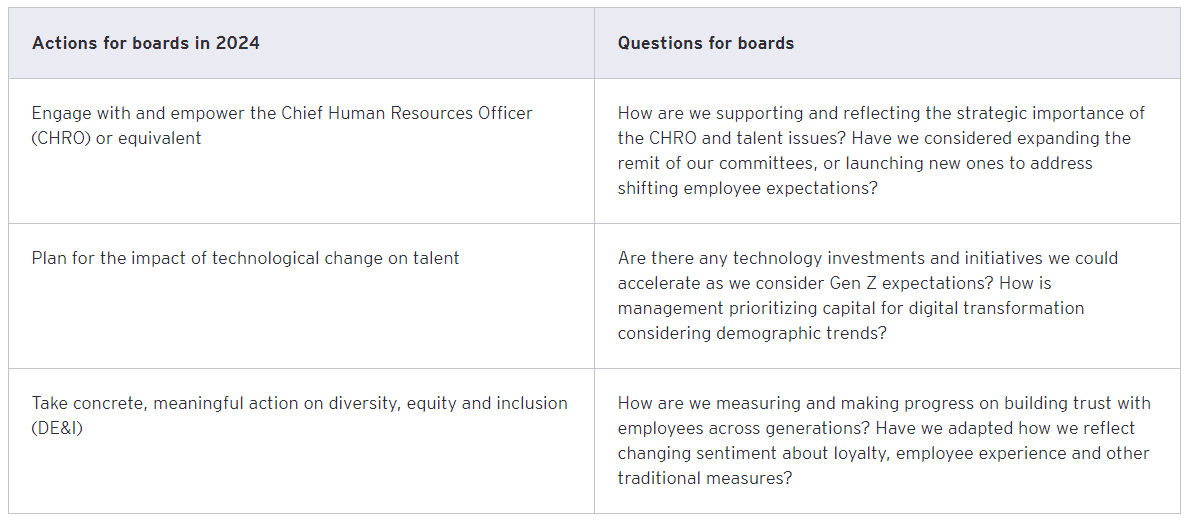

Chapter 3: Preparing for an AI-fueled People-Centric Future

Talent remains high on the agenda as boards adapt to the changing global workforce.

Talent – its availability, acquisition and retention — comes equal second with capital allocation (previous chapter) in directors’ 2024 priorities. Talent will become even more of a priority given the rapidly changing global workforce.

By 2025, Generation Z — those born between the mid-1990s and 2010 – will comprise 27% of Asia-Pacific’s workforce. Organizations face tough competition in attracting the best of this cohort to be the data and technology experts’ core to competitive advantage.

Boards in Japan were more likely to rate talent availability, acquisition, and retention as critical areas of concern than those in Korea or Australia. Nevertheless, boards across Asia-Pacific should ensure their management teams have a process for tracking external trends and their impact on talent. Inviting external experts, such as behavioral psychologists to periodically present at a board meeting can help. Similarly, collaborating to develop an employee value proposition that meets the needs and wants of a multi-generational workforce is also key.

Riza Mantaring, board director of multiple Philippines organizations including Ayala Corp, First Philippine Holdings Corp and Bank of the Philippine Islands, says: “We have a dire shortage of data scientists and analysts and people with AI expertise. Organizations recognize this and are doing all they can to develop talent.”

Talent indicators are a valued tool. In the 2023 EY Global Board Risk survey, 77% of Asia-Pacific directors were satisfied with metrics to assess talent risks, compared to 68% across Europe and the Americas. And 40% of Asia-Pacific directors rated their CEO succession planning measurements effective, compared to 30% globally. However, some directors were concerned about the long-term talent pipeline.

“We have a dire shortage of data scientists and people with AI expertise. Organizations recognize this and are doing all they can to develop talent.”

Riza Mantaring – Board director of multiple Philippines organizations including Ayala Corp, First Philippine Holdings Corp and Bank of the Philippine Islands

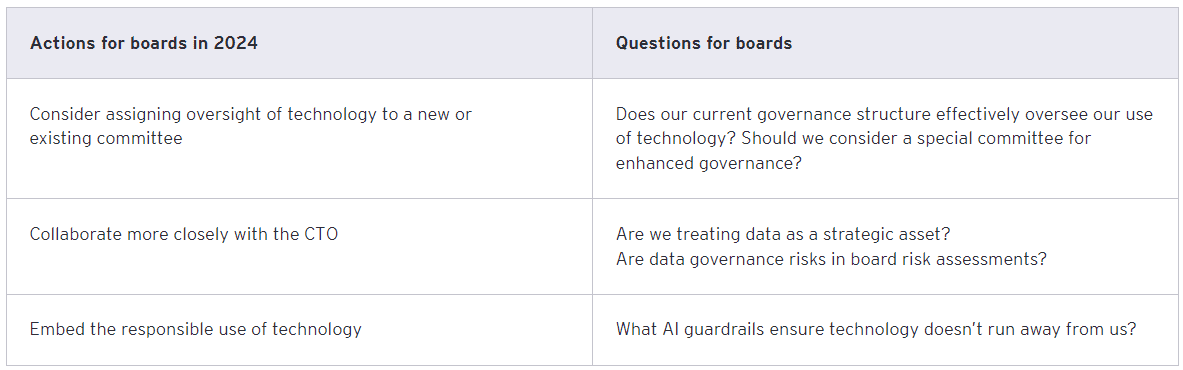

Chapter 4: Boards Adapt to Accelerating Pace of Digital Change

Asia-Pacific boards dash to harness Generative AI.

Disruptive new technology is top of mind for Asia-Pacific directors, 40% of whom are prioritizing digital transformation readiness and business model changes in 2024.

Generative AI (GenAI) was the 2023 game changer. In our CEO Outlook Survey, 71% of Asia-Pacific respondents said they must act now on GenAI to avoid losing strategic advantage. However, in our survey, only 44% of directors believe they have enough information to oversee innovation appropriately, and just shy of half believe they spend the right amount of time doing so.

Directors also ranked data-related compliance, a key priority. In addition to focusing on protecting and safeguarding data, many companies are also seeking to ensure that their data-collection measures comply with rapidly changing rules and regulations pertaining to data. “Both domestic and multinational companies in mainland China are paying more attention to compliance risk in relation to privacy, consumer protection and fair competition rules and regulations” says Leung.

As data generated by a range of sources, including AI, becomes more prevalent, boards have a key role to play reminding executives to exercise proper care and oversight of their existing data. Data protection is particularly important for board directors from Australia, who rated cybersecurity and data privacy as more important topics than those their counterparts in Korea and Japan. This is largely due to a recent spate of cyber incidents in Australia, with cybercrime in Australia jumping by nearly 25% in 2023.

“Both domestic and multinational companies in mainland China are paying more attention to compliance risk in relation to privacy, consumer protection and fair competition rules and regulations”

Philip Leung – EY Greater China Markets Managing Partner (retired), board director of multiple Chinese state and privately owned companies listed on stock exchanges in Shanghai, New York and Hong Kong

New technology has placed increasing importance on viewing data as a valuable currency. The challenge now facing boards and their organizations is to find the best way to leverage this data to fine-tune customer offerings. This has the potential to radically transform entire markets.

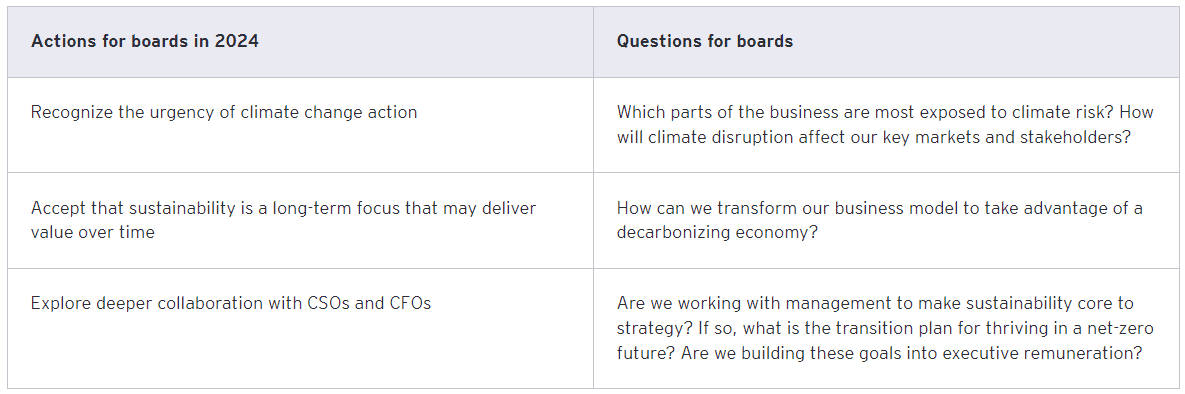

Chapter 5: The Climate Emergency – Keeping Sight of the Big Picture

Boards must recognize climate change is an urgent risk.

2023 was the hottest year on record. Climate-related weather events incurred costs of more than US$143b per year from 2000 to 2019. Apart from the financial cost, rising sea levels threaten the viability of island nations and extreme weather endangers lives. Only 21% of respondents ranked climate change as a key concern, yet nearly half said they lacked sufficient information on the topic. A recent EY Sustainable Value Study revealed some organizations are winding down commitments to net zero and modestly reducing investments to achieve those goals. Organizations with revenue above USD $5 billion are more likely to rank climate as a higher priority (47% compared to 13% for smaller organizations).

Boards seem more concerned about the costs of climate regulation. Minimizing such costs remains a primary focus for Asia-Pacific directors, more so than in the Americas or EMEIA. This is worrying; boards’ long-term responsibilities require them to prioritize climate and sustainability issues.

Chapter 6: Preparing the Board for the Future

Boards want to focus more on innovation, talent, cyber and climate.

“Board operating models might not be fit for purpose in five years, almost two-thirds of directors say.”

Asia-Pacific 2024 board priorities survey

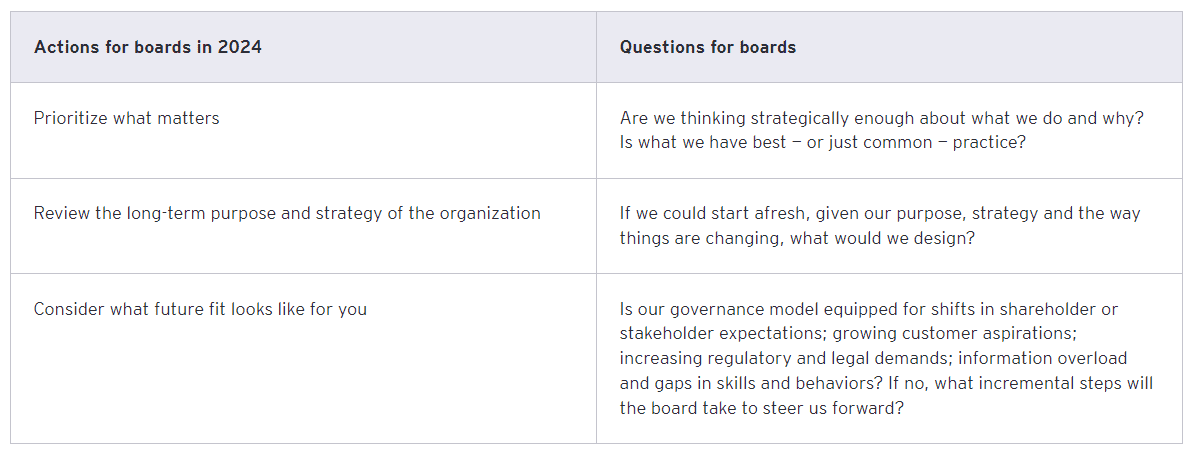

To discover how the complex issues raised might affect board governance and how the rate of change could alter the way business works, we asked boards three questions:

1. Is there enough time and information?

Directors said they spent enough time on most issues, but want more discussion on innovation, talent, cyber and climate change. Nearly half said they want more information about innovation and evolving technology, cybersecurity, and data privacy.

The challenge probably extends beyond time and information however, to the depth and sophistication of information now required to support decision-making. And there’s little evidence that boards are using AI and technology to reduce their workload or to mine data.

2. Do you have the right skills?

Almost two-thirds (65%) of directors felt they had the skills and capacity to provide effective oversight. But how will they feel in five years, when faced with more information, change and complexity? Most boards, when asked, identified gaps in digital literacy and “soft skills,” such as behavioral science. Diversity also lags.

3. Is the operating model fit for purpose?

Directors see their current operating model as fit for purpose. But barely one third were certain it would remain so in five years.

It may be difficult to consider changing the status quo, but we see mounting evidence (via EY.com Australia) that the one-size-fits-all approach to board structures may no longer meet the needs of all organizations. To address this, boards across Asia-Pacific need a plan and the right mindset to transform their governance models. The case for change is strong, but exactly how Asia-Pacific boards decide to move forward with transformation is less clear and will depend upon each organization’s current state, levels of maturity, future strategy, and long-term purpose.

Join the conversation on #BoardMatters

This article focuses on priorities for Asia-Pacific boards. The EY Center for Board Matters also focused on the Americas and EMEIA , providing insight into operating environments on a global scale.

Summary

Most Asia-Pacific economies remain buoyant, despite the “stabilized volatility” that could potentially constrain regional economic growth in 2024. Still, boards in Asia-Pacific recognize the need to evolve — and to do so quickly — as they prepare for a future world marked by rapid technology changes and geopolitical instability.

5.0

5.0