- COVID-19 highlights the importance of integrated corporate governance, or more fully integrating ESG&D factors into the governance, strategy and operations of companies.

- The World Economic Forum has outlined six ways Boards can translate stakeholder capitalism into practice.

- This leadership agenda will help companies remain competitive and resilient in the long term as well as address systemic societal challenges.

The COVID-19 crisis is accelerating a shift toward a more integrated approach to corporate governance that has been gathering force for some time. The pandemic has put people’s lives, livelihoods and learning at the centre of the public policy and business response in almost every country and industry sector. It has dramatically underscored the need for firms to engage proactively and systematically with diverse stakeholders, both internally and externally. And, it has highlighted companies as stakeholders themselves with an intrinsic interest in and shared responsibility for the resilience and vitality of the economic, social and environmental systems in which they operate.

What does this mean in practice? We outline a six-point Leadership Agenda for corporate Boards that we believe will be essential for ensuring their companies’ longer-term competitiveness and resilience as well as addressing some of the systemic societal challenges that have been thrown into sharp relief during the pandemic. This agenda is relevant for any Board or company that is serious about absorbing the deeper lessons of the current crisis for their firm and translating the principles of stakeholder capitalism into practice.

Since the beginning of the century, major technological, environmental, geopolitical and socio-economic changes have been transforming the expectations and operating context of business, compelling a re-examination of corporate governance principles and board practices. In particular, these changes have rendered environmental, social, governance and data stewardship (ESG&D) considerations substantially more material to the fundamental purpose of companies – sustainable value creation. This is eroding the traditional distinction between a shareholder primacy model of corporate governance focused on financial and operational risks and opportunities, on the one hand, and a stakeholder-driven model of corporate responsibility and citizenship focused on environmental and social risks and opportunities, on the other.

The substantial economic contraction triggered by the current global public health crisis is the latest example of the heightened materiality of ESG&D factors in our more interconnected and interdependent world. Coming on top of recent protests about inequality, injustice and climate change, #MeToo scandals, air, water and climate-related production and financial losses, employee health and safety disasters, trade war-related supply chain disruptions, cybersecurity breaches and growing concerns about personal data privacy and ownership, and skilled-worker shortages and immigration restrictions that companies have faced in many countries, this crisis should eliminate any doubt in boardrooms that ESG&D factors have the potential to destroy substantial value in short order or even threaten the viability of a business. As such, they need to be more fully integrated into the governance, strategy and operations of companies rather than segmented and de facto subordinated as matters of corporate social responsibility, as they traditionally have been.

Such integrated corporate governance is the essence of stakeholder capitalism. It is what is required to give practical effect to the vision and principles articulated in the World Economic Forum’s updated statement on The Universal Purpose of a Company in the Fourth Industrial Revolution and the US Business Roundtable’s revised Statement on the Purpose of a Corporation, as well as a growing number of aligned regulatory and voluntary frameworks around the world.

The leadership imperative for Boards and their executive teams as they emerge from crisis management is to translate these general principles into specific practice. If stakeholder capitalism is to be more than an optimistic vision, it will require this integration to become better defined in operational and governance terms and such practices adopted in widespread fashion by Boards.

We see six inter-related areas requiring heightened Board stewardship in particular:

#1: Align strategy and capital allocation with drivers of long-term value creation

Boards must align their strategic and particularly capital allocation priorities with key drivers of long-term value creation. As companies adapt to a new economic context, changed workplace conditions and raised expectations following the pandemic, alongside ongoing environmental constraints and acceleration toward digital transformation and the Fourth Industrial Revolution, they must intensify their focus on intangible drivers of value. These include research and innovation, employee wellbeing, talent development, corporate culture and respect for human rights, and strengthening external stakeholder relationships and trust. Capital allocation priorities need to be rigorously challenged to balance near-term returns to shareholders with investments in long-term growth opportunities, supply chain resilience and human, social and natural capital and infrastructure.

Collective initiatives such as the World Economic Forum’s Compact for Responsive and Responsible Leadership, Focusing Capital on the Long Term, the Embankment Project for Inclusive Capitalism and the Aspen Institute’s programme on Long-Term Capital provide examples of the action that leading companies are taking, more of which is needed.

#2: Internalize material ESG&D factors in enterprise risk management

As part of their risk oversight responsibility for operational, financial, reputational and regulatory risks, Boards must gain more in-depth understanding of rapidly evolving environmental, social, governance and data stewardship (ESG&D) risks. They must provide oversight on the material risks these pose to the company’s own financial condition and operating performance as well as the salient risks their company’s activities pose to people and the environment. In addition, they must be able to rigorously evaluate alternative investment, innovation and technology options for mitigating current risks and avoiding future ones.

Committing to science-based climate targets and reporting against the Task Force on Climate-related Financial Disclosure (TCFD) are growing imperatives for most corporate Boards. Likewise, setting public goals on water stewardship, nature-based solutions and contributions toward a circular economy. In terms of the “S”, respect for human rights, protection of people’s health and safety, greater inclusion and diversity, and investment in tackling inequality and developing skills for the future are key priorities. Governance issues include clarity around corporate purpose, ethics, compliance, anti-corruption, tax payments and political engagement. And, key data stewardship priorities for Boards are cybersecurity, the use and governance of artificial intelligence and machine learning, and privacy and data ownership issues associated with data collection, management and use. In all cases, there are growing regulator and investor demands for specific corporate commitments and accountability.

#3: Strengthen preparedness and resilience to crises and systemic shocks

Systemic crises and shocks are on the rise, ranging from financial crises, recession and political conflicts to natural disasters, the impact of climate change and pandemics. Boards play a crucial role in providing oversight of their company’s ability to respond to and recover from these. To improve preparedness, they must undertake more regular and sophisticated scenario analysis and horizon-scanning activities, ‘stress-test’ the company’s resilience against shocks that may have system-wide implications, and put crisis response and emergency succession plans in place for mission critical roles at the executive and operating level.

In a crisis management situation, the Board’s role is to support management in putting people first, especially the health and safety of employees and other stakeholders, supporting critical functions and operations for business continuity, and providing oversight of financial risks and resilience. As soon as possible, directors should be engaging with management to explore recovery options, changes to strategy and business models that might be needed, and opportunities to improve operational, cultural, financial and technical resilience in future.

#4: Engage the firm in cooperative efforts to strengthen its operating environment

Boards have a greater stake than ever in the health of their company’s operating context, particularly the strength of the social fabric and the norms and public institutions that underpin the functioning of rule of law, respect for human rights and fair and efficient markets in jurisdictions with significant operations. For example, they should engage with management to: Shape the firm’s investment in education and training to prepare the future workforce and support a just transition for people whose jobs and livelihoods will be affected by automation, shifts to online and remote working, the transition to low carbon economy, and other fundamental economic shifts;

- Review their global tax policies and practices to ensure fair payment of corporate taxes that are needed to support public goods and services and effective public institutions;

- Identify areas where the company can play a role beyond its own operations in tackling structural inequality and injustice based on race, ethnicity, gender, sexual orientation and other forms of personal identity and/or on household income, for example through investments and advocacy to expand economic opportunity and advance social justice.

- Consider how their companies can contribute to collective public priorities such as the UN Sustainable Development Goals and Paris climate agreement, including through policy dialogue and advocacy in support of these goals.

#5: Prepare the company’s mainstream reporting in an integrated manner

There is a growing imperative for Boards and management to prepare the company’s mainstream disclosures in an integrated fashion that combines financial reporting with reporting on material ESG&D risks and opportunities. The increased materiality of these factors requires well-governed corporations to reflect them in their mainstream disclosures and to ensure greater transparency and accountability to investors and other stakeholders by setting public targets, providing independent assurance on performance against these targets and analysis of strategic risks and opportunities.

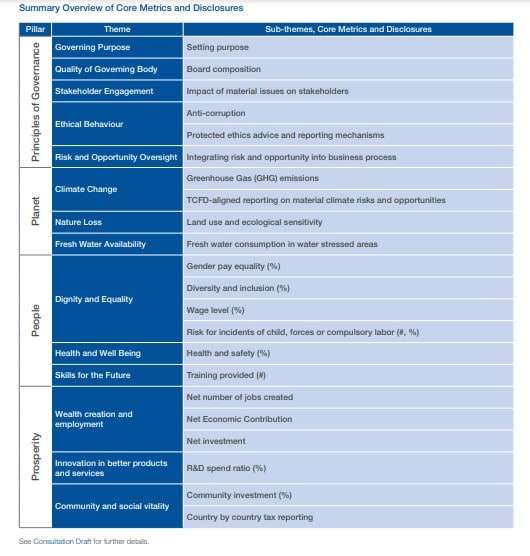

Working with Deloitte, EY, KPMG and PWC, the World Economic Forum’s International Business Council is spearheading an effort to identify a core set of ESG metrics and disclosures that are common across industry sectors, which can be integrated into mainstream reporting on a consistent and comparable basis. In addition, initiatives such as the Task Force on Climate-Related Financial Disclosure (TCFD), the Sustainability Accounting Standards Board (SASB), Climate Disclosure Standards Board (CDSB),

Global Reporting Initiative (GRI) and CDP are providing guidance on more issue- or sector-specific disclosure priorities. All Boards should be familiar with and able to provide oversight on the evolving agenda for corporate reporting and accountability.

#6: Adapt the Board’s organization, composition and engagement to these imperatives

Boards need to integrate these issues into the way they are structured and organize their work. A key area for review is the integration of ESG&D oversight into different Board Committee charters and whether to establish a dedicated Board committee to address these issues. Likewise, ensuring the right balance between Committee-based work and integrating these issues into full Board discussions on corporate purpose and culture, strategy, risk management, scenario and competitiveness analysis, major investment decisions, business planning, target setting and performance oversight, executive compensation and succession planning.

Being fit-for-purpose requires much greater diversity of director skills, experiences, gender, race, nationality and age. In addition, Boards need to increase internal engagement, including but beyond the company’s executive management team, as well as engagement with external stakeholders from investors to scientific, community and government leaders.

This six-point agenda for leadership action merits consideration by any Board regardless of jurisdiction, ownership structure or business model. It is a call to action and practical resource for Boards seeking to keep pace with changing economic circumstances and social expectations – to “walk the talk” of stakeholder capitalism – as they emerge from the current crisis and reset their firms’ operations and governance in accordance with lessons learned. If business is to restore and sustain public trust and if stakeholder capitalism is to realize its potential, Boards must integrate these principles and practices across industry sectors and countries. In today’s world, such integration is essential to create long-term sustainable value for shareholders and other stakeholders alike.

The article was first published here.

Photo by Tamara Gak on Unsplash.

5.0

5.0