Article by Svein Tore Holsether, President and Chief Executive Officer, Yara International for World Economic Forum

- According to the United Nations, global greenhouse gas emissions will be 10% higher in 2030 compared to 2010.

- While indirect emissions account for 70% of a business’s carbon footprint, direct emissions are still the primary focus for most companies.

- Larger companies should cut emissions in their upstream and downstream productions and shift focus to scope 3 emissions.

The race to reach the global 1.5-degree Celsius threshold is under way, but the real test is our ability to cut ‘scope 3’ emissions.

According to the United Nations, the world’s greenhouse gas (GHG) emissions are still set to be 10% higher in 2030 compared to 2010. Consequently, it becomes imperative that businesses look beyond their emissions and focus on the complete range of their value chains instead.

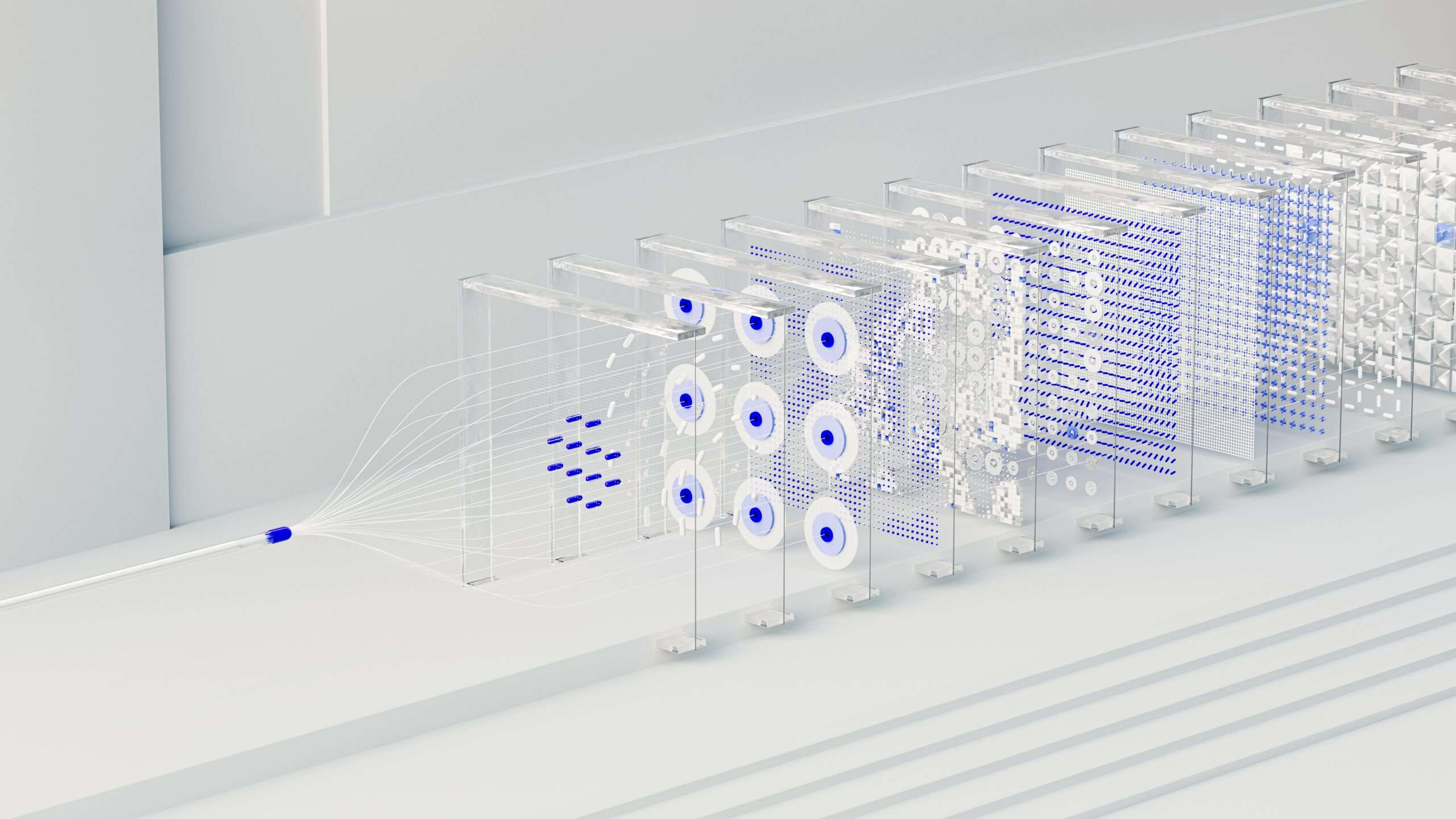

The Greenhouse Gas Protocol Corporate Standard classifies a company’s GHG emissions into three scopes:

-

Scope 1 emissions are direct emissions from owned or controlled sources.

-

Scope 2 emissions are indirect emissions from the generation of purchased energy.

-

Scope 3 emissions are indirect emissions (not included in Scope 2) which occur in the company’s value chain – both upstream and downstream..

Cutting Direct Emissions is Not Enough

Direct emissions are the primary focus for most companies, but it’s not nearly enough to stunt global warming and deliver on the Paris Agreement. Since scope 3 emissions usually account for more than 70% of a business’s carbon footprint but aren’t generally reported on ESG (environmental, social and governance) reports, shifting focus to this class is crucial in reaching climate targets.

In November, industry players and the world’s largest sovereign wealth fund, Norges Bank Investment Management (NBIM), gathered in Paris to discuss the advancement of scope 3 emissions. Similarly, Yara is working with several food companies to collaborate on this type of emission and has asked a wide selection of our suppliers, partners, and customers to formulate an action plan. Companies cannot tackle this alone – collaboration is the only way.

Nicolai Tangen, the CEO of Norway’s $1,3 trillion fund, emphasised its efforts in investing in companies with net-zero targets. He also disclosed a few interesting numbers: in its portfolio of more than 9,000 companies, as much as 70% of emissions come from only 174 companies. This reveals the weighty responsibility large companies have. Companies like Yara have the power to drive entire value chains in the right direction, but it would require new thinking.

We Must Move Downstream

From Yara’s point of view, we’ve reduced our emissions by 50% and are on course to decrease them by an additional 30%. Even so, our numbers indicate that 78% of our combined emissions fall within scope 3, suggesting that it’s not enough to cut upstream production – we must move downstream to cut field emissions too. Next year we will introduce renewable energy-based fertilisers to significantly reduce food production emissions, from chips and bread to milk and orange juice.

The same applies to other industries that source from farmers, like the fashion industry. Fossil-free alternatives in producing and transporting cotton clothing, for example, can significantly reduce the industry’s carbon footprint.

I recently welcomed Argentina’s largest potato farmer, El Parque Papas, to our head office in Oslo. The company’s leader, Walter Hernandez, recognised his role in reducing emissions, stating, “Mass production of potato chips is a very complex operation involving many elements. It is my mission to introduce a completely green, emission-free potato in 2024.”

Here are four key fundamentals for success:

1) Think Whole Value Chains:

According to BCG, the cost of decarbonising the top eight value chains – that account for 50% of GHG emissions – is as low as 1-4%. These numbers are highly manageable and decisively discredit the notion of “hard to abate” or “costly to abate” sectors.

2) Break the Silos:

We must share knowledge and build trust. It all comes down to our willingness and ability to cooperate.

3) Invest in Renewables:

We must accelerate investments in renewables and drive the cost of decarbonised products down. The aim should be to drive demand through so-called cost parity with fossil-based products within only a few years.

4) Carbon as a Currency:

We must rally behind data on climate. If companies and people are to put money on the table to pay for lower-emission products and solutions, they need to trust the labelling or performance data. In the same way, they trust currencies and should view carbon as a currency.

ESG is still facing criticism on numerous fronts – often because it fails to factor in the complete environmental footprint of a product or company. The next step for businesses is to lift scope 3 emissions into public discourse and separate the greenwashers from those who walk the talk.

The article was first published here.

Photo by CHUTTERSNAP on Unsplash.

5.0

5.0