Over the past few years, regulators have been demanding for better corporate governance and expecting much better insight into corporate governance and reporting practices on a range of key issues, from diversity to climate change. The corporations are urged to review their economic practices and mind-sets, putting greater focus on decision making and how this led to sustainable benefits for the shareholders and wider stakeholders.

Some of key areas of Corporate Governance in which changes are particularly being called for and raised debates on a new intensity are:

- The purpose of the corporation;

- The role of shareholders; and

- Value creation and sustainability in the long term.

This is a fundamental debate about how we do business. The coronavirus pandemic has shown us that the way we do business is threatening the world. We want more and faster ways to maximize profit without understanding the consequences of destroying the environment and resources that are needed to run our business. Many are realizing that this form of capitalism with its emphasis on increasing short-term outcomes and focusing solely on profits is no longer sustainable. The pandemic raised a question that we rarely dared to ask ourselves: what is the true purpose of your business and what values should your business represent?

It is about the paradigm shift in how we do business

It is about changing our mentality and adopting a long-term perspective

As the response to today’s social and environmental challenges, a new model like the ‘stakeholder capitalism‘ is gaining ground. The main idea is to strike a balance between shareholder primacy and stakeholders’ interests. A new Davos Manifesto2020 released by the World Economic Forum states that businesses must be stewards of the environment, uphold human rights throughout their global supply chains, and pursue sustainable shareholder returns that do not sacrifice the future for the present.

More investors are also looking for ways to link environmental and social benefits to financial returns. The course shift has to take place, a shift away from the single-minded focus on profits and industry pressures to boost short-term results. But it will not happen without changing the culture and values that drive business.

We have come to a point where the debate about the new way of doing business has to come to an end. In today’s world of digitalisation, workforce transformation, shifting consumer attitudes and increased climate risk, the board plays a more active role than ever before in setting the tone for changing mentality, the values in the business and adopting a long-term perspective.

The Board’s Role in Helping Management Navigate Challenges

- Navigating Strategic Dualities

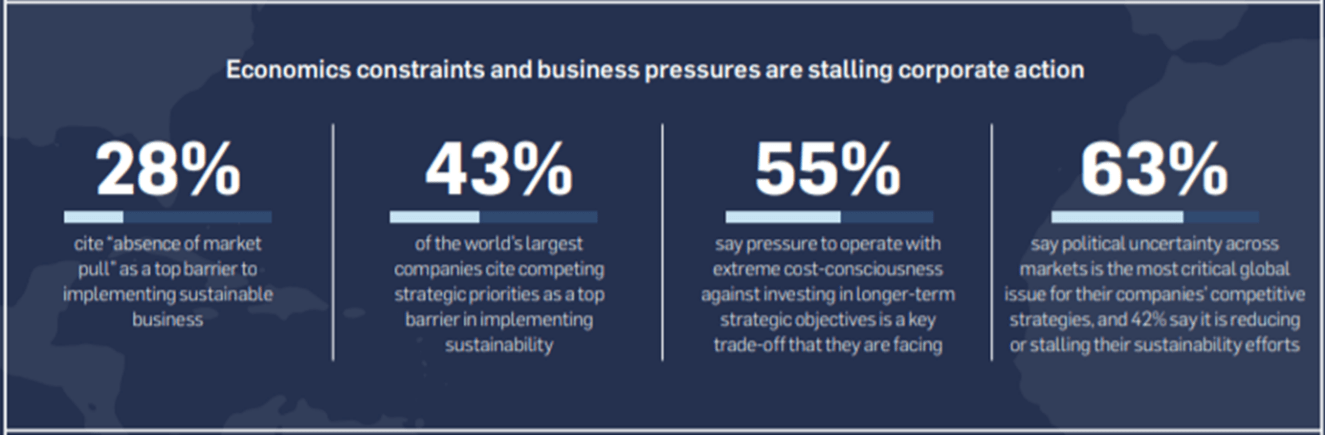

The board plays a vital role in helping the management in navigating the strategic dualities in today’s world and understanding that effective corporate social responsibility management is not incompatible with shareholder value, and having wider interests can be the key to long-term financial performance. The board is responsible for setting and reconfirming the company’s purpose. A well-defined purpose will help to develop long-term strategy, operating practices and approach to risk. An effective board will manage the conflict and will find a balance between the short-term interests and the long-term impacts of its decisions.Currently, a bias towards short-term rather than long-term performance is stalling corporate actions. Accenture’s 2019 Strategy CEO Study on Sustainability shows that 55% of management says the pressure to operate with extreme cost – consciousness against investing in the longer-term strategic objectives is a key trade-off that management is facing (Picture 1).

Picture 1

Over the past decades businesses became very transactional, focusing on today’s profitability and readiness to use any opportunity in the short-term horizon. Some of the strategic dualities in the Corporate Governance requiring consideration and striking the balance are:

- Shareholders vs. Stakeholders

Should companies be seen only as vehicles for profit maximisation, or have a wider social role?

- Short-term vs. Long-term

Is planning for long-term sustainable growth possible in an increasingly volatile, global, tech-driven, and competitive economic environment that is focusing on maximising share price in the short-term?

- Disruption vs. Sustainability

How the company can be disruptive and sustainably innovate at the same time?

- Overseeing the Organisation’s Culture and Promoting Sustainable Mindset

The importance of robust oversight of culture by the board is recognised by the regulators. The board should oversee how management demonstrate and communicate the company’s purpose and values, drive the right behaviors and whether the company’s compensation practices are aligned with its values.Effective setting and delivering of a strategy is underpinned by the values and behaviors that shape the culture of an organisation and the way it conducts its business. Without the right culture and the right people, a company is likely to face competitive challenges and a potential failure in embedding corporate social responsibility management. Organisations will need people who can help activate the imagination aimed at resolving dilemmas, and those who can simply propose a different way of functioning.

An effective board will promote values and behaviours that drive sustainable mindset of the management.

- Making decisions focusing on Long-term Value Creation that may be unpopular with short-term oriented stakeholders.

- Recognising the Interconnectivity of the Ecosystem in which business operates.

- Actively Engaging with Stakeholders and seeking to understand a wide range of points of view.

“Change requires individuals who recognise that new things can be done and who take the initiative to get them done … The existing bureaucracies, public and private, will not take on the job of changing what is.”

Lester Thurow

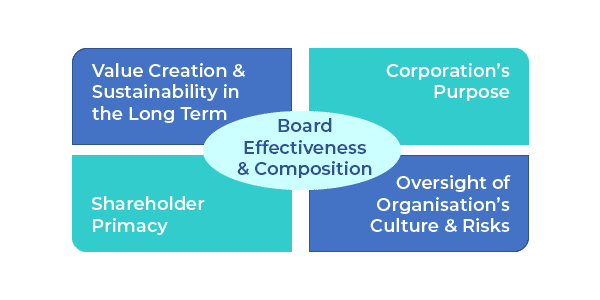

- Board Effectiveness

Regulators place considerable emphasis on board effectiveness as well as decision-making and its outcomes (Picture 2). Boards are encouraged to reflect on the way in which decisions are taken and how that might affect the quality of those decisions. As per the Financial Reporting Council “The boardroom should be a place for robust debate where challenge, support, diversity of thought and teamwork are essential features. Diversity of skills, background and personal strengths are important drivers of a board’s effectiveness, creating different perspectives among directors, and breaking down a tendency towards ‘group think’”.

Picture 2

The board’s values and behaviours will shape the culture and the way the company conducts its business. The behaviours that they display, individually as directors and collectively as the board, set the tone from the top, which is critical in changing the mentality and adopting a long-term perspective. Effective board will actively engage with stakeholders to understand a wide range of points of view and have courage to make decisions focused on long-term value creation that may be unpopular with short-term oriented stakeholders.

* This article does not attempt to cover every aspect of corporate governance but focuses on the selected topics relevant for publicly traded companies.

This article was written by Beata Cymerys, an ICDM Board-Ready Affiliate and former Chief Audit Executive of Citibank subsidiary in Poland; a passionate audit professional with over 20 years of experience in banking, insurance and manufacturing sectors. Beata partnered with senior management and Board members, in particular the Audit Committee members, to identify current and emerging risks, ensuring the safety and soundness of the organisation.

Photo by Dan Freeman on Unsplash.

5.0

5.0