Learn six key actions to help improve your digital strategy and realize a return on digital investments.

- Digital leaders have clearer strategies and better technical execution, resulting in higher return on digital investment and revenue growth.

- Internet of Things (IoT), cloud and AI become table stakes as digital spend accelerates, but most companies have yet to realize full technology benefits.

- CXOs have differing preferences on organic vs. inorganic digital investment strategies. Digital M&A is more likely to exceed expectations.

After years of heavy technology spending, CEOs, chief digital officers and other senior executives are feeling the pressure to realize return on digital investment (RODI). Budget constraints in the pandemic economy, deals that fail to deliver as promised and the rapid pace of digital transformation across organizations threaten to turn digital promises into mere buzzwords — unless organizations can prove the value of their investments to the bottom line.

The EY team and Oxford Economics surveyed 1,001 executives with technology decision-making responsibility across industries worldwide about their digital strategies and results. The EY Digital Investment Index (DII), conducted in the third quarter of 2020, provides a snapshot as organizations recalibrate strategies in response to the COVID-19 pandemic.

The results show that some technologies such as cloud computing and artificial intelligence (AI) have become table stakes, but scaling these digital initiatives remains a challenge. Executives are not yet aligned on investment strategies and struggle to measure the returns on their investments. The best practices of a select group of leading companies provide a possible way forward for organizations to achieve higher returns from their digital investments.

This synopsis concludes with six recommendations for senior executives to leverage lessons learned from digital leaders. How can your company improve performance? Read on to discover additional insights such as how digital M&A can lead to higher median share price returns.

Chapter 1

Learning from digital leaders

Strategies that digital leaders employ to achieve the benefits of their investments.

Meet the digital leaders

We identified a select group of survey respondents who have achieved higher return on their digital investments and say they are digital leaders in their industry. These respondents:

- Represent just 9% of the survey’s 1,001-respondent sample

- Achieve around six percentage points more return on digital investments compared to non-leaders

- Report stronger revenue growth over the past two years (49% report revenue growth above 6% over the past two years, vs. 29% of others), and expect strong growth in the future

- Have more mature strategies for their digital investments and ways to execute them

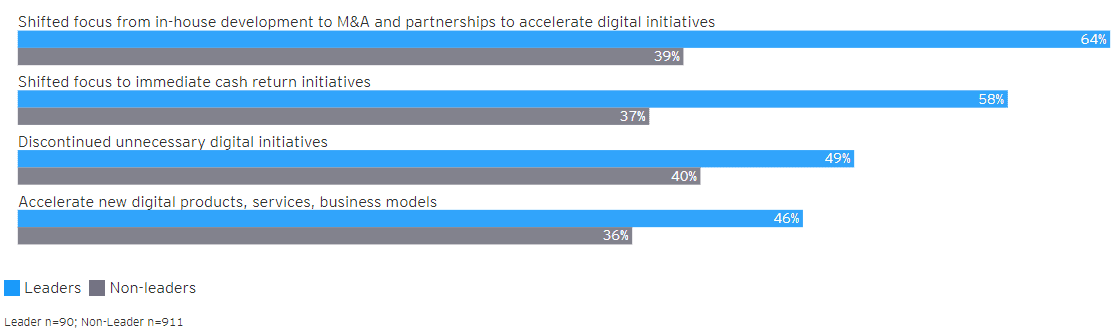

Fig. 1 below shows how digital leaders are boosting their resilience as they enter the next phase of the pandemic, and the traits that give them an advantage when it comes to making the most from their digital investments.

Fig. 1: Leaders are futureproofing the enterprise

Q. Please rate the status of the following actions considered by your company regarding enterprise resilience.

Digital leaders have a strategic advantage

In addition to accelerating new digital products, services and business models, digital leaders are much more likely to:

- Have a clearly defined strategy for digital (48%, vs. 36% of others)

- Reprioritize their digital initiatives to focus on those with immediate cash returns, while discontinuing unnecessary initiatives

- Dedicate funds saved to accelerate new digital products, services and business models

- Invest in the right emerging technology to execute on that strategy (53% vs. 45%)

That technology mix is more likely than others to include investments in internet of things (IoT), cloud computing and advanced cyber defense — showing that digital leaders are creating a strong foundation (through cloud and cybersecurity) to rapidly accelerate emerging technology solutions (such as AI/IoT).

To meet their strategic goals, nearly three-quarters of executives say they are shifting to M&A and partnerships to accelerate digital initiatives (see Fig. 1) — on average, digital leaders are shifting approximately five percentage points of their investment mix from building internally to M&A. That shift is important, as the EY survey shows that these investment vehicles are more likely to perform above expectations (see Chapter 3).

For now, digital leaders are an elite group. What digital leader traits can other companies adopt as they chart a path forward?

Chapter 2

Making the most of digital investments

Digital leaders measure business value delivered while they build a data analytics foundation.

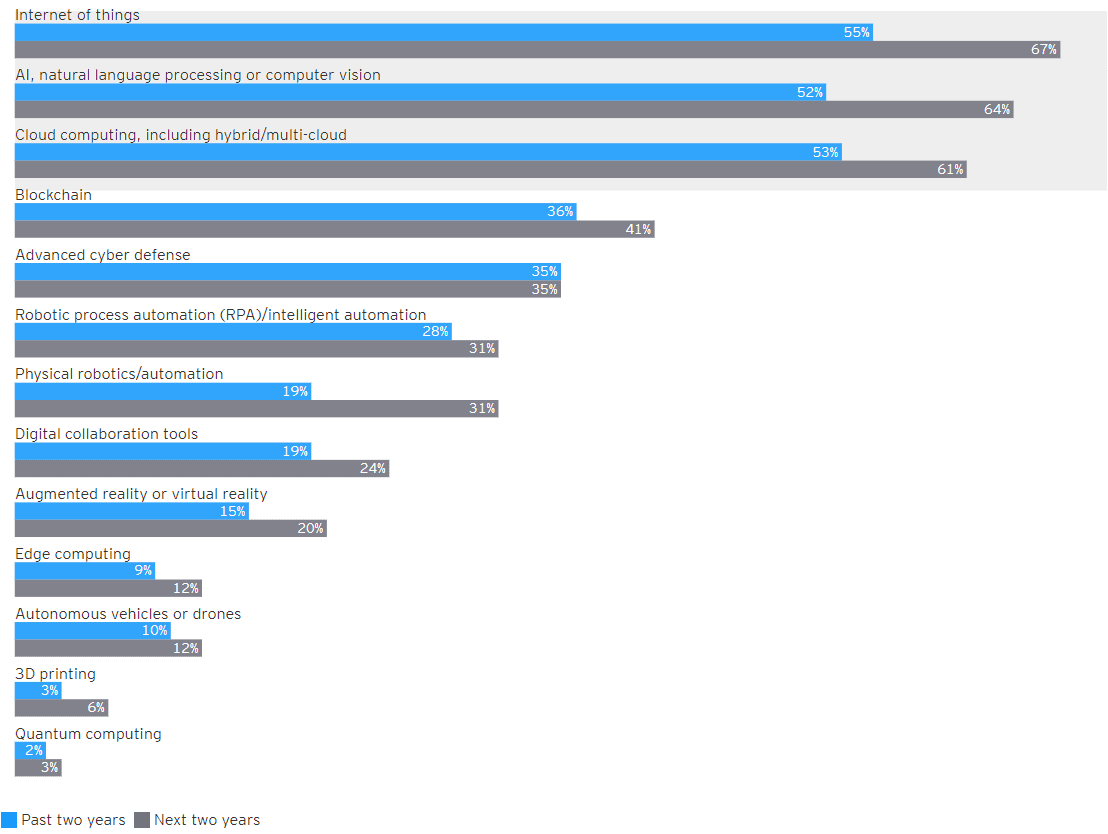

Futureproofing technology investments

Nearly two-thirds (62%) of executives agree that organizations must radically transform their operations over the next two years. To do that, executives are starting to turn to emerging technologies. Fig. 2 shows that IoT, AI and cloud computing have become table stakes. Executives also predict large jumps in investments in automation, and digital collaboration tools. While these investment plans are not on par with those of digital leaders, the gap is closing.

Fig. 2: IoT, AI and cloud computing are table stakes

Q. In which of the following emerging technologies has your company focused its investments over the past two years and next two years?

Slow going on reaping technology value

Progress in realizing the full benefit from emerging technologies is slow. Just 15% of executives say they have realized the full value from their cloud investments — perhaps the most foundational of the table stakes, as it enables many other emerging technologies. Just 7% say they have realized the full benefits from AI/IoT. Most of these technology investments appear to be in the launch or acceleration phase — close to realizing benefits, but not quite there yet.

This survey shows similar results when it comes to progress in digitizing core processes across the organization — just 2% are realizing full benefits, with two-thirds in the early development (34%) or launch (30%) stage.

Understanding what stands in the way of benefit realization

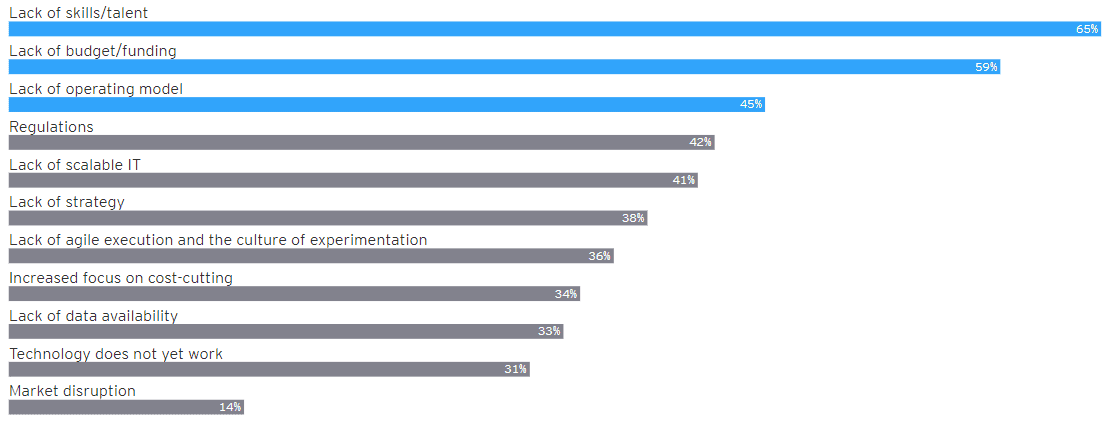

Those executives still in the development stage of digitization should be careful — 79% say that digital programs stall in that early phase. And the reasons are legion:

- 65% say digital programs stall due to lack of skills or talent.

- 59% cite a lack of budget.

- 58% cite poor-quality data or the lack of a strong data analytics function as top data-related challenges.

The data piece of the equation is critical. Executives need to validate that data is shared easily within the organization by breaking down silos and supporting a strong data analytics function. Digital leaders pursue a dual track: focusing on short-term value where data is available today (e.g., pricing data analytics), while at the same time building the necessary data infrastructure for the future.

Chapter 3

Aligning on organic vs. inorganic investment strategy

Choose the right investment vehicle mix and M&A integration approach to accelerate digital.

Shifting to digital M&A and partnerships

This survey shows that executives know which technologies they need to succeed in a digital future. But there is misalignment when it comes to the investment vehicles they use.

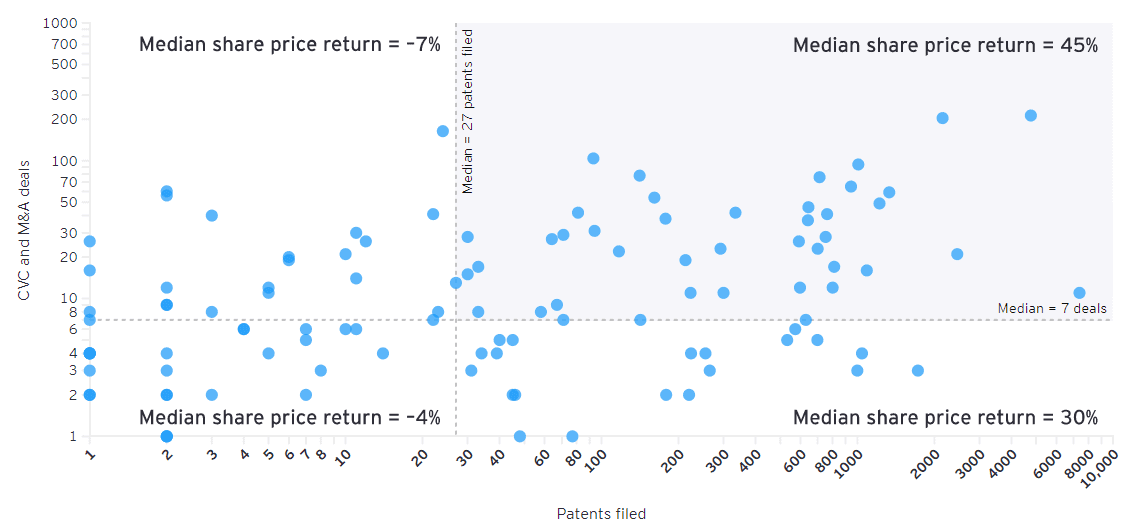

Additional data analysis from CB Insights shows that building internal capabilities, using patents filed as a proxy, is critical in driving value as reflected in the median share price return segments in Fig. 3, below. However, the optimal approach is found in pursuing a balance of both organic (patent) and inorganic (M&A and CVC) strategies to capture both value and speed.

Fig. 3: Organizations with more acquisitions and patent filings show higher share price returns

While balancing the development of in-house capabilities as well as M&A, CVC and partnership investments, survey respondents are more likely to say digital M&A exceeded expectations (52%) than any other investment vehicle. (Partnerships come in second place, with 45% saying they exceeded expectations.)

Executives need to be aligned on investment strategy

Digital M&A may be more likely to exceed expectations for some, but the risk of failure is high. A lack of executive calibration may doom digital M&A initiatives from the start. Executives who report that digital M&A investments met or were below expectations cite misaligned sources of value as the top reason (64%).

That misalignment is concerning. With more than half of executives planning to use digital M&A or partnerships to accelerate digital initiatives, it is essential to make sure the goals and values of an organization and those of acquired or partner firms are coordinated. Internal alignment is also challenging — just 43% of executives agree that digital leaders from functional groups are fully aligned on their organization’s digital M&A strategy.

Alignment and collaboration pay off. Executives who reported that partnerships and digital M&A met or exceeded expectations were significantly more likely to say that they were implemented by multiple executives (e.g., a combination of CFO, CIO and others).

In order to create an investment strategy that meets goals across the organization and adds value, executives need to be aligned on the mix of investment vehicles used by the organization — and continue that collaboration when it comes to taking ownership and directing those investments. Breaking down organizational silos and playing to executives’ individual strengths (e.g., relying on chief digital officers to develop in-house capabilities, while tapping CEOs to lead on M&A) are the best ways to develop a successful investment strategy.

Chapter 4

Overcoming barriers to scale

Realize digital value with skilled talent and a flexible digital operating model.

Lack of skills and budget stalls digital programs

Organizations without a clearly defined digital strategy are putting themselves at risk. But even the most flexible and technology-enabled strategies can be hamstrung by other issues. Fig. 4 shows that a lack of skills (65%) and budget (59%) are the top barriers to digital programs, with a lack of operating model not far behind (45%).

Fig. 4: Skills, budget and operating model challenges hamstring digital programs

Q. What are the top reasons why your company’s digital programs are stalling?

These barriers help explain why less than 10% of all respondents — including digital leaders — say they are currently realizing the full benefits of their digital efforts.

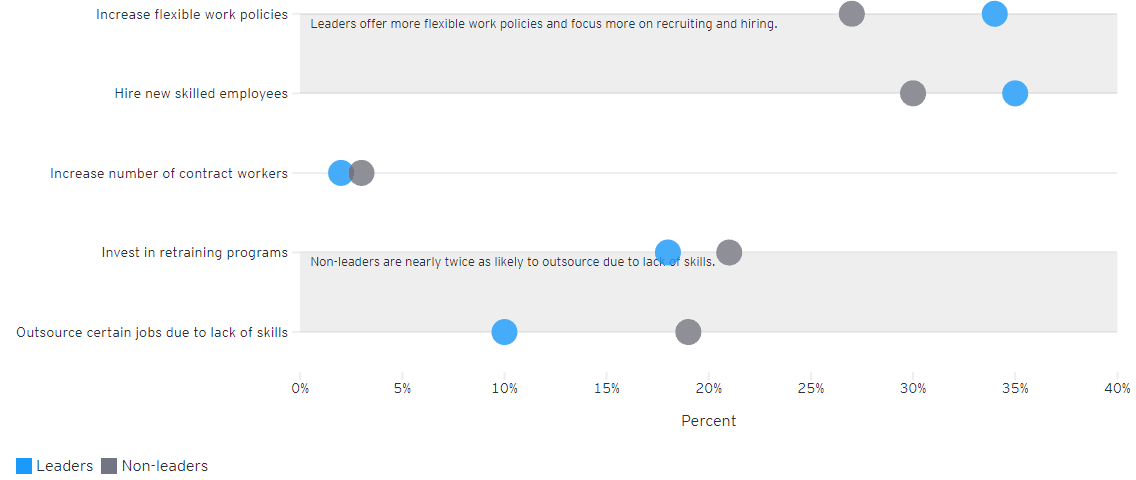

Skill at scale

To effectively scale digital investments, the organization needs to be empowered with the right skills. Fig. 5 shows that the digital leader group is more likely to focus on hiring new employees to boost their digital skill sets, while non-leaders are more likely to be reskilling existing employees or outsourcing.

Fig. 5: Leaders look outside the company to obtain skills

Q. Which of the following has your company done to enhance the digital skills available to you?

To overcome key barriers to realizing value, companies will require highly skilled employees and an effective, flexible digital operating model. Yet only half of executives say their operating model meets their goals. Operating model issues, combined with skills and strategy shortages, explain why many organizations are struggling to scale their digital initiatives.

Though the barriers are similar for new business development and core process digitization, the best ways to remove those barriers differ. For example, operating model issues for a new, digital business may be better solved through a structured approach that can include creating clearly defined milestones, bringing in new native digital talent and clearly defining outcomes. On the other hand, digitizing the core may center around agile, cross-functional teams. Regardless of the objective, companies must be able to experiment and discontinue initiatives that are not working.

Chapter 5

Establishing robust governance and metrics

Establish a strong governance model and KPIs to manage digital initiatives.

Return on digital investment: The RODI advantage

In a cash-constrained environment, proving the value of all investments — including digital — takes on an increased importance. While more than three-quarters of executives say that digital initiatives have been critical to their organization’s success over the past two years, putting firm numbers on this success remains a work in progress.

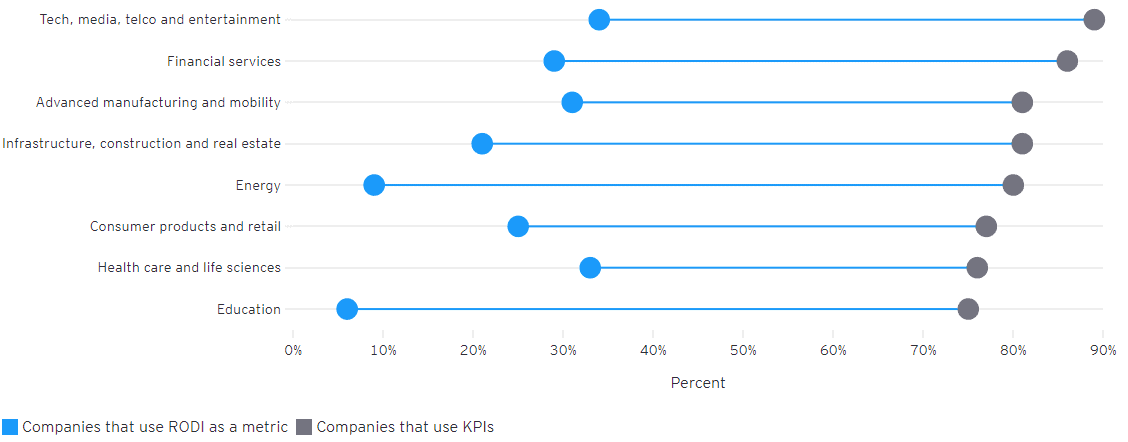

Less than a quarter of executives say they actively measure RODI, though other KPIs are more common, including KPIs about financial performance (57%) and operational efficiency (46%).

Among the sectors represented in this survey, technology, media and telecom; (TMT), financial services; and advanced manufacturing and mobility (AM&M) are the most likely to use KPIs in general, and around one-third of them use RODI as a measurement (see Fig. 6).

Fig. 6: Measuring RODI may lead to higher returns

Q. Do you currently measure the impact of your company’s digital investments?

Tech, media, telco and entertainment, financial services and advanced manufacturing and mobility lead the pack on measuring RODI. Companies that use RODI as a metric were 50%+ more likely to achieve 5%+ RODI in 2019. This suggests that wide use of KPIs, including RODI, may result in higher returns, perhaps because these organizations are more in tune with the performance of their digital investments and operations.

Overcoming barriers to accurate RODI measurement

Measuring RODI is not always easy. More than half of executives say a lack of clearly defined strategy and goals is a top barrier to measuring RODI. Companies must have an effective governance model in place to quantify success, focusing on results and scale.

Skills and data gaps often prevent companies from measuring the success of digital initiatives. Executives must work to obtain talented employees (through new hires or reskilling), while breaking down intracompany barriers to data sharing so they can correctly measure their RODI and meet strategic goals.

Conclusion

It is clear from these survey results that executives have work to do to improve their digital investments — and to accurately measure that payoff. We recommend the following actions:

- Determine a clear strategy that details digital spend, technology requirements and a coherent path to execute. Few survey respondents say they have a clearly defined strategy, and even fewer say those strategies are flexible. Both are necessary to weather disruptions and succeed in the future.

- Align executives on the right investment mix of “build, partner, buy, corporate venture,” and develop an integrated approach to accelerate digital initiatives and achieve strategic goals. Depending on the digital initiative, tech requirements and internal capabilities, “build, buy, partner” may lead to different RODI and speed of implementation.

- Consider digital M&A as a means to further accelerate post-pandemic digital performance, and use partnerships to close funding gaps.

- Focus on hiring and retaining top talent, securing access to funding and improving operating models, while learning from the digital leaders to achieve the full benefits of digital investments.

- Establish a strong governance model and KPIs to manage digital initiatives in order to accurately measure RODI, identify potential weaknesses in digital strategy, learn and adjust.

- Rebalance your portfolio of initiatives during the pandemic. For example, cash-generating initiatives should be prioritized in the short term to fund future growth through new digital products and services.

Summary

The EY Digital Investment Index report helps leaders understand how to improve their digital strategy and enhance their return on digital investment.

5.0

5.0