This is Part 3 in our blog series on Board Evaluations. To access other posts, see below:

- Part 1: Back to Basics: Why the Board Evaluation is a Critical Building Block

- Part 2: What Are the Barriers to Effective Board Evaluations Today?

- Part 3: Five Elements of a Successful Board Evaluation

- Part 4: Recommended Evaluation Formats: Mapping a Three-Year Plan

- Part 5: How and When to Choose a Facilitator for Your Board Evaluation

- Part 6: Three Guidelines for Taking Action on Board Evaluation Results

In the previous post, we discussed the barriers that boards often face when conducting board evaluations. Self assessment can be an uncomfortable process (whether at the board, committee, or individual level), and it can be perceived as disruptive to a busy board agenda or director collegiality. Now, we begin to outline solutions as we discuss fundamental elements of a successful evaluation process (and how to ensure each one is in place).

1. Clear Goals & Objectives

What do you want to accomplish with your board evaluation? Are you trying to streamline a critical board process? Align the board’s composition with a new corporate direction? Or are you just conducting an evaluation to meet your annual stock exchange requirement? As with any board initiative, the first step is to determine what the board is hoping to achieve. Goals should be agreed upon at the board level; then the nominating & governance committee should outline specific objectives, which are used to determine the appropriate evaluation format, facilitator, and frequency (often over a multi-year time horizon).

2. Buy-In or Commitment from Directors

Boards motivated merely by compliance will struggle to produce the kinds of insights that drive real change. They’ll also struggle when it comes time to disclose their evaluation process for investors like BlackRock who want to know “how boards are assessing the skills and expertise needed to take the company through its future multi-year strategy (rather than the last one).” Director buy-in is the second element of a successful evaluation process. This kind of commitment, however, can be difficult to inspire when it’s not inherent for certain directors. How can a board ensure its directors take the process seriously?

Commitment to the board evaluation process is a byproduct of a healthy board culture—one that balances collegiality with the willingness to challenge the viewpoints of management or fellow directors. This aspect of board culture must be clearly communicated during the on-boarding process, where all incoming directors are made aware of the board’s commitment to performance measurement. Ultimately, it’s the responsibility of board leadership to ensure that both new and sitting directors understand the board’s expectations, which brings us to element #3.

3. Effective Board Leadership

It’s not easy to counsel a non-contributing director on how they can improve performance. It’s even more challenging to inform a director that he/she will not be renominated. These are potential outputs of the board evaluation process, and this is where the lead director, non-executive chairman, or chair of the nominating & governance committee earns their fee.

Effective board leaders possess a specialized skill set; he or she is adept at having tough conversations and initiating change—all the while navigating a delicate social fabric. This unique skill set not only underpins the board evaluation process, but also various other aspects of board governance. Boards must keep this in mind as they elect their next lead director or non-executive chairman.

4. Follow-Through on Results

Element #4 is not only the most important step in the board evaluation process, but it’s the most overlooked. Too often, companies do a good job conducting the board evaluation, but then little is done with the results. If not to improve performance, then what else are board evaluations for?

Whether the responses are critical or affirming, a follow-up conversation must take place at the board level and (when needed) at the individual director level. Board leadership is responsible for ensuring that action is taken on the evaluation results, whether that means counseling a board member directly or assigning tasks to the committees. Evaluation topics will often cover everything from time management to composition and culture. Sometimes the action taken can be as simple as tweaking a board process, devoting more time to strategy, or creating more opportunities for directors to build camaraderie outside of the boardroom.

5. Evaluation Disclosure

Today’s shareholders want to know what your board is doing to self-assess. Concerned with the board’s composition and its flexibility to adapt, major institutional investors seek to understand what kind of process the board has in place.

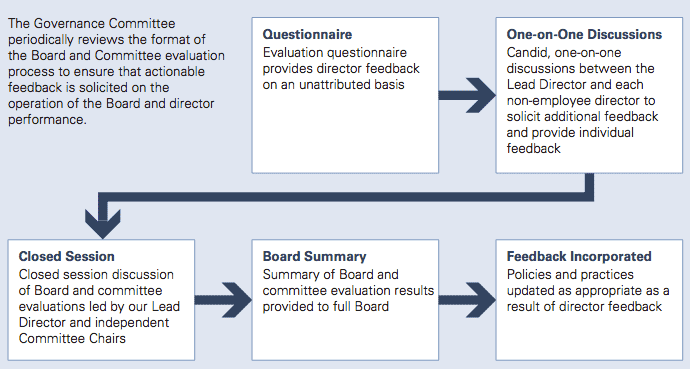

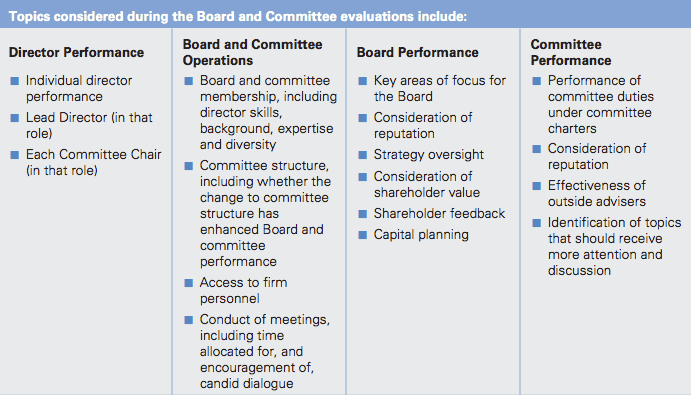

On page 155 of the Guide to Effective Proxies, Donnelley Financial Solutions provides a dozen examples of board evaluation disclosures. The screenshots below were pulled from Goldman Sachs’ 2016 proxy statement, where the company visually discloses its multi-step evaluation process (including formats and topics), along with an in-text description of its on-boarding process for new directors.

5.0

5.0