Diversity on boards has been a topic of growing interests today. The ambition for more diverse representations in boardrooms has been championed by many, including the 30% Club Malaysia which was launched in 2015 to inspire sustainable business-led voluntary change to support gender diversity on boards. With this effort, we see a slight improvement in the number of companies with at least 30% female directors on boards[1] – from 9% in 2016 to 19% in 2019.

However, true board diversity goes beyond just gender. Companies must meet the needs of various stakeholders, including shareholders, employees, customers, supply-chain partners, communities and the environment. The ideal way to represent a diverse group of stakeholders is a well-constituted governing board comprising directors who provide diversity of thought, experiences, and perspectives. In this regard, it will be meaningful to expand the definition of diversity to cover board independence, as well as age, tenure, culture and expertise.

In the recent Malaysia Board Diversity Study conducted by the Institute of Corporate Directors Malaysia (ICDM) with Willis Towers Watson (WTW), we examined over 300 top companies with primary listings under Bursa Malaysia (“Bursa”) against these multiple dimensions of board diversity.

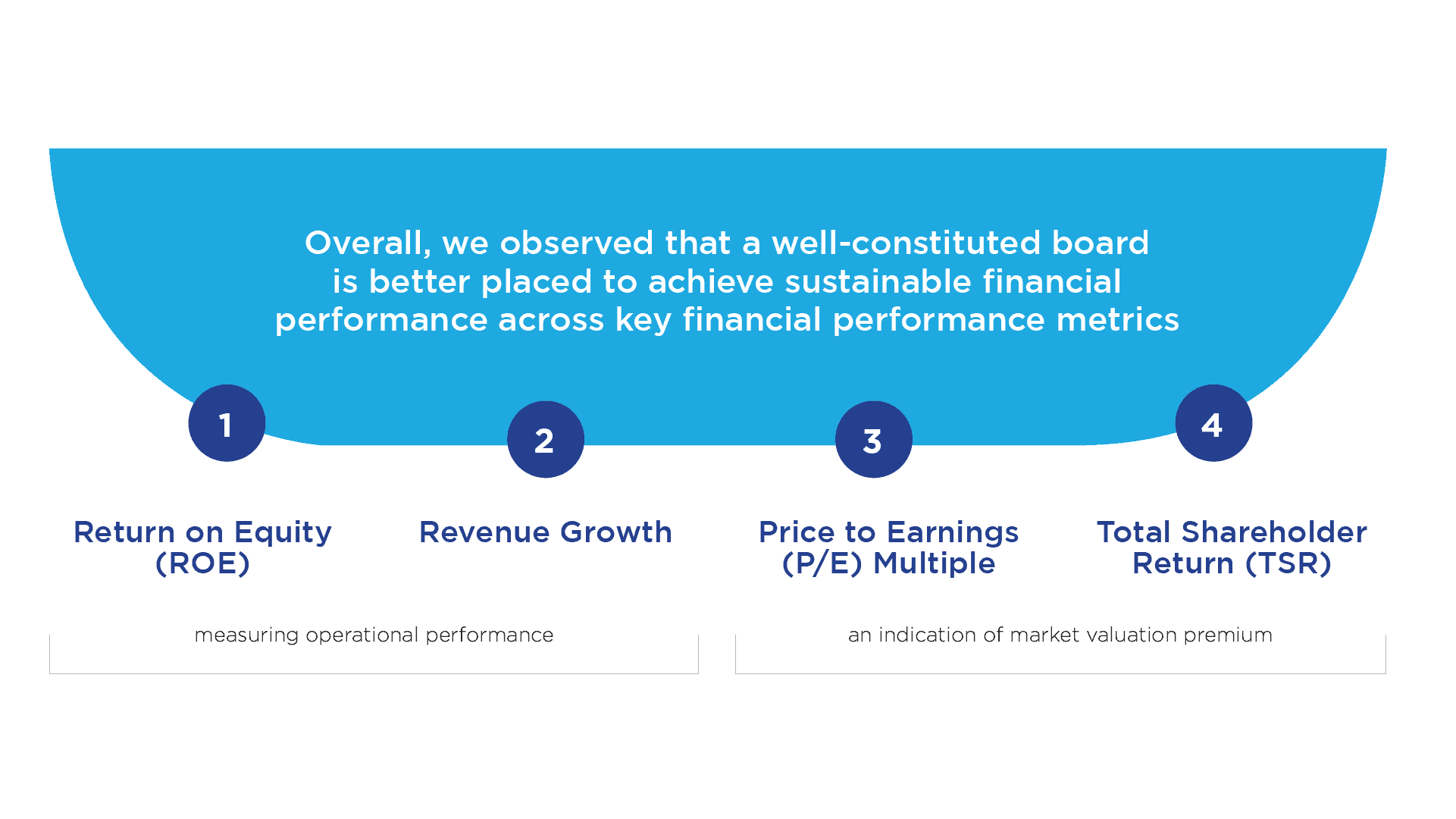

To assess the business impact of board diversity, we tested whether companies with diverse boards performed better financially. The premise being that having a diverse mix of non-executive directors (NEDs) may lead to avoidance of group-think, constructive debates, and in turn, better decision making on boards.

A well-constituted Board is better placed to achieve sustainable financial performance

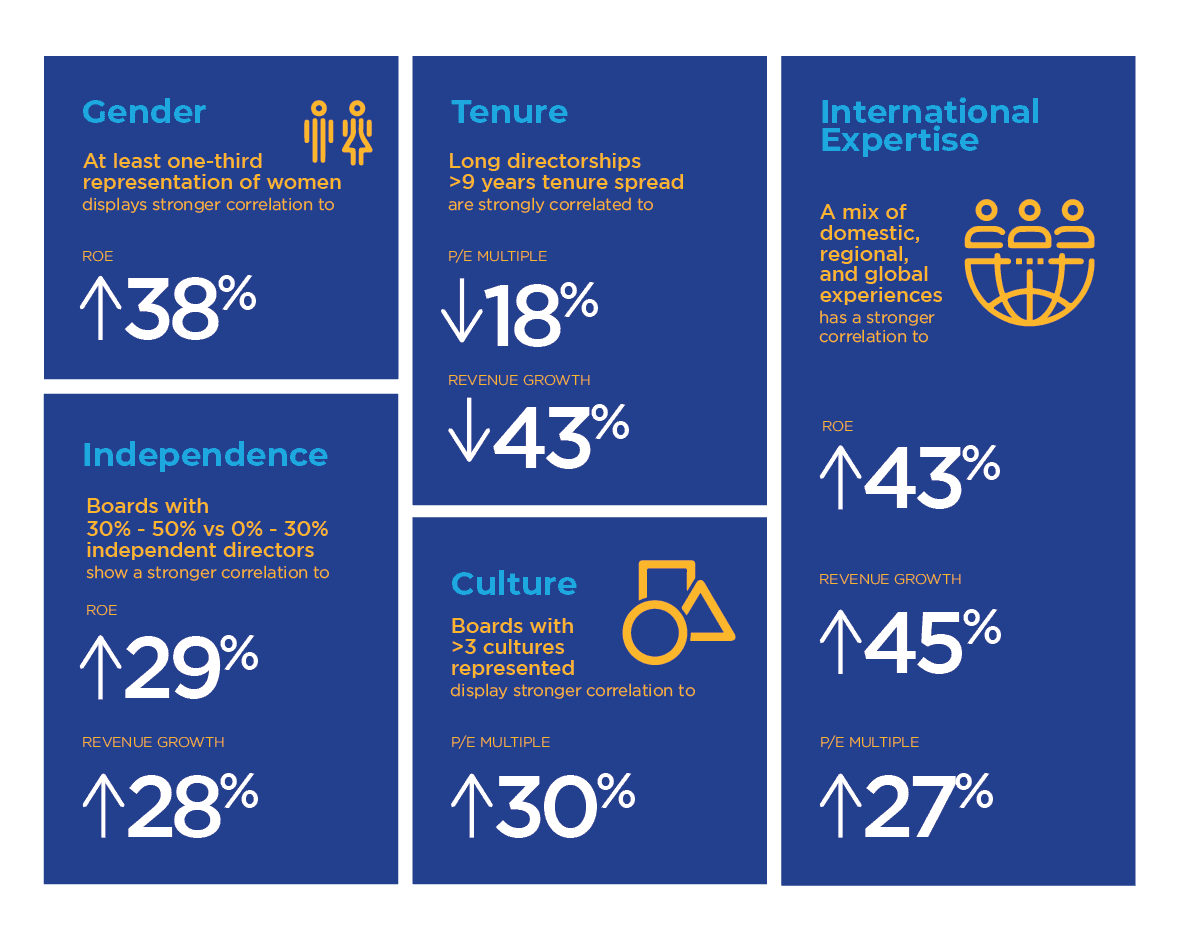

The Malaysia Board Diversity Study, which examined the top 312 Bursa-listed companies over the past three years (2017-2019), suggests a strong relationship between the following board diversity attributes and company financial performance.

Please note that this study only measures correlations and not causality. We are not claiming that a diverse board automatically guarantees good financial performance; and conversely we are not claiming boards that are not diverse will necessarily report poor financial results. Our study simply examines the correlations between companies that have exemplary diversity attributes and their corresponding financial performance. This study is based on data for time-period from 2017-2019.

Gender diversity

Gender diverse boards with a mixed representation of male and female directors can bring different perspectives and approaches to stewardship and risk-reward orientation to the table, which in turn enhance the quality of board decisions made.

In 2019, 19% of Malaysian board seats were held by women, an increase from 2016’s 14%. However, there is still much room to enhance the current gender representation on Malaysian corporate boards.

Our study has shown that boards with at least one-third women representation correlates with 38% higher median ROE than boards with no women representation. A larger representation of women seems to suggest more inclusive boards.

Board independence[2]

A balanced board with independent and non-independent representation allows for more considered decision-making. Independent board members can bring external expertise and are more likely to make decisions aligned with all stakeholders’ interests.

We observed that boards with 33% – 50% independence correlates to better financial performance with 29% higher ROE and 28% higher revenue growth compared to boards with 0% – 33% independence, thus supporting the hypothesis that boards with an optimal balance between independent and non-independent representation are likely to outperform others.

Age diversity

An age-diverse board with a good mix of older and younger directors can bring holistic perspectives to the boardroom. Representation of varied age groups has been found to broaden debates, reduce the risk of groupthink and allow businesses to stay relevant in the market.

In Malaysia, we observed that board of family-founded businesses tend to have a higher diversity in age, where succession planning has provided opportunities for younger directors to participate in boardroom discussions.

While we did not observe a significant correlation between age spread and company financial performance in this study, we still see the importance of a balance between younger directors who can bring fresh ideas and older directors who often offer a wealth of experience which enhance company’s performance. This view is also supported by past studies from the 2019 Willis Towers Watson Singapore Board Diversity Study[3] and others.

Tenure diversity

Boards benefit from the fresh ideas and experiences of newly appointed directors, balanced with the institutional knowledge and continuity provided by long-serving directors. A healthy balance between the two allows for more measured decision making, and consequently stronger company performance.

Our study shows that boards comprising of directors with overly long tenure (i.e. boards with tenure spread of above nine years) exhibit 43% lower revenue growth and 18% lower P/E multiple as compared to companies with smaller tenure spread.

Cultural ethnicity

Cultural backgrounds and values shape individuals’ behaviours. Culturally diverse boards benefit from broader range of experiences, reduced risk of cultural prejudices, and sensitivity to stakeholders from different cultural backgrounds.

Malaysian boards have done particularly well in this regard with over 80% of companies having two or more cultures. A strong link can be drawn between cultural diversity and performance. Companies that have directors from more than three different ethnic backgrounds show stronger correlation with higher P/E multiple.

Expertise diversity

Having board members with a broad range of expertise can help the board respond more quickly to changes, provide different experiences and expertise for sound decision making, and even provide access into critical markets.

We see that a good mix of directors with domestic, regional, and global experiences correlates to higher financial performance. Particularly, boards with stronger international expertise performed 43%, 27%, and 45% higher than their peers in terms of ROE, P/E multiple, and revenue growth respectively.

Diversity on boards is increasingly, and deservedly, gaining prominence across the world. Directors with diverse backgrounds bring diversity of thought and experiences to the board’s deliberations, which in turn leads to more considered decision making and enhanced business performance. Furthermore, having a diverse board avoids groupthink, helps increase social acceptability, and in turn ensure that the board conducts itself appropriately.

It is hence important for Malaysian companies to critically and periodically review their board composition to work towards a truly diverse board. This can start from challenging the traditional ways of sourcing directors (i.e. through independent sources rather than through personal networks) and focus on evaluating directors through a holistic assessment of their skills, experiences, and diversity of thought.

Four key actionable steps for Malaysian boards

Relook at your board architecture

Board refreshment may be necessary, especially with overly long tenure directors and consideration for additional independent non-executive directors. A board skills matrix analysis may also help determine the skill gaps needed to be filled.

Look beyond your inner circle for new board candidates

Start utilising independent and unconventional sources to identify suitably qualified candidates. You may get a wider and diverse pool of candidates to choose from.

Evaluate your board effectiveness

The Nomination & Remuneration Committee to assess whether the current board mix is aligned to your organisation’s future growth strategy.

Constantly acquire new skills and knowledge

Refresh your knowledge, keep up with the latest trends, issues and developments that may impact you and your organisation so you can better contribute at your board(s).

References

[1] Boards of the top 312 Bursa-listed companies sampled in this Malaysia Board Diversity Study.

[2] The Bursa Malaysia Main Market Listing Requirements (LR) requires all companies to have at least 2 directors or 33% of the board to be independent. In addition, the Malaysian Code on Corporate Governance 2017 (MCCG) recommends that independent directors comprise at least half of the board. For large companies, a majority of the board.

[3] The study showed a strong relationship between company performance and age differential among board members, where companies with at least one generation difference tended to outperform in terms of ROE, P/E multiple and revenue growth. Willis Towers Watson. Singapore Board Diversity Study, 2019.

Shai Ganu is the Managing Director, Global Practice Leader – Executive Compensation at Willis Towers Watson. Michele Kythe Lim is the President and CEO of the Institute of Corporate Directors Malaysia (ICDM).

Download the full article at the right sidebar to read more.

4.2

4.2