Families who own successful businesses and have a vision for their future generations in that business need to plan for that vision today. Family business owners need to have a strategy in place to leave the family and the family business in a better and stronger position for their future generations. We discussed the importance of having a strong owner strategy in our previous blog.

The objective of having an owner’s strategy that is customised to your own family’s needs is that it sets a common understanding for all relevant family members to move forward with the same vision, and addresses the relevant areas that could potentially create conflict among your family members. Conflict or potential conflict if left unattended, over time, can and will manifest in cracks in your family members’ relationship with one another. When family members are not able to interact well with one another, it is likely to adversely affect your business as they will be unable to see eye-to-eye with each other when deciding on key business matters.

The challenges that could lead to conflict most commonly happen at the second generation and beyond. There are current owners who feel there is no need for them to have a strategy for their future generations as the relationship among family members are currently harmonious or they believe that the next generation will resolve their own issues in time. Here is where lessons learnt from other successful family business owners can create a powerful impact in ensuring a lasting legacy for their families.

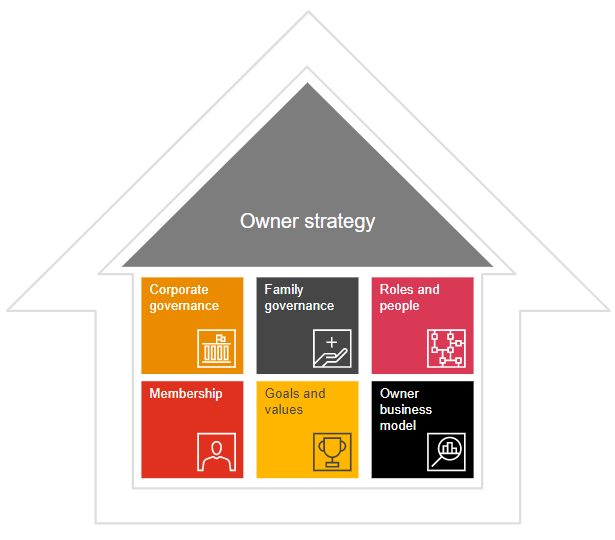

Based on experience, the following 6 building blocks are key in coming up with your customised owner’s strategy:

- Membership

- Goals and values

- Owner business model

- Corporate governance

- Family governance

- Roles and people

The 6 building blocks are sufficient to cover the relevant areas in developing your own owner strategy. It is important to remember that in developing your family business’ owner strategy, the process is more important than the end goal, and there must be active participation by the family members.

To give you an idea, here are some questions that could be raised in the course of developing an owner’s strategy. Do note that these questions are not exhaustive:

- How and when do family shareholders pass on ownership?

One of the most fundamental issues faced by family shareholders is how and when to pass on ownership of the business. There are many issues to consider in deciding this, such as, who can become a shareholder? At what age can they become a shareholder? When does the current shareholder transfer their ownership? How and when do they transfer their ownership? These need to be given careful thought early on to avoid conflict and disputes once the time comes to expand the ownership to the broader family and the next generation.

- What are the goals for the business that the family wants to achieve and what are the values they want to uphold?

While most businesses would have their vision and mission statement in place, the family should also consider the values they wish to uphold and the goals they want to achieve for the business as it grows and expands. This would provide guidance to ensure that business dealings are carried out in a way that reflects the prescribed values of the family (who are the owners). It also brings family members from the current and next generation together on the same page in achieving personal and business goals that have been agreed upon. Otherwise, in time, different family members could have views of the future of the business that may not be aligned.

- Is evolution of the business model allowed?

As businesses expand, there may be opportunities to diversify and evolve. As change carries risks, the family must be aligned in agreeing on whether that change is consistent with the family’s goals for the business. In some family businesses, there is an emotional attachment to the founder’s original business model. If the conditions for change are not addressed, it could result in loss of focus and control, amongst other things. It will do well for the family and the business if the founder gives his/her blessing for the growth of the business subject to conditions that the current and next generation agree upon.

- What are the rules regarding compensation of family members working in the business?

Compensation can be a very personal matter that most family members may not wish to discuss with one another but it is very frequently the root of conflicts. While family businesses have the freedom to design their compensation packages as they see fit, the owner’s strategy must have a plan to address situations where compensation that is received by family members involved in the business vary for various reasons.

- How do family members make decisions that are consistent to avoid conflicts between one family branch with another?

Generally, having family governance mechanisms in place such as a shareholders’ agreement or a family constitution should pre-empt most conflicts that could arise in a family business. However, this does not eliminate the possibility of conflicts arising on occasion. Furthermore, when family and business are intertwined, and emotions are in play, conflicts could get personal and the spill-over effects could be detrimental if not dealt with properly. This is why having a mechanism such as a family council who takes the role of an executive committee at the family level would be beneficial to address and resolve these issues.

- Which family member(s) is best suited to take on responsibilities into the next generation? Having a good business model and family council achieves very little impact if the roles and responsibilities of relevant family members are not spelt out and agreed. As the number of family members increases, there will be different needs to be fulfilled. Is there someone who will lead the family council? Who will be responsible for the family office? Who is responsible for philanthropic activities of the family? Which family member should be CEO of the business? And the list goes on. The selected family members should obtain the trust and respect of other family members in carrying out the relevant roles and once again, the owner strategy should have the mechanism to address this.

Ultimately, here are 5 benefits of having an owner’s strategy:

- Strengthens family members’ bond and unity as they have worked together to identify and articulate their thoughts and wishes to produce and document the family constitution

- Results in higher levels of trust, openness and attachment once the difficult conversations have taken place

- Ensures clarity and transparency. The family members know what the agreed process is and how to use it to address most obstacles in a timely manner when they arise

- When the agreed way forward is put in writing, it is clear and everyone is on the same page

- Smoothens the transition from the current generation to the next

Our studies have shown that taking the time and putting in the effort to develop an owner’s strategy is an important contribution towards family cohesion and the future success of the family business.

This article was first published here.

Photo by Jacques Bopp on Unsplash.

5.0

5.0