Asia-Pacific CEOs brace for a severe but temporary recession as they head into an uncertain 2023.

In brief

- Asia-Pacific CEOs expect the upcoming downturn to be severe but temporary, mitigated by timely fiscal and policy decisions.

- CEOs seek to balance between protecting what they have and staying future-focused to emerge from the downturn in a position of strength.

- Appetite for transactions remains high, but many CEOs are opting for joint ventures (JVs) and alliances as a more judicious approach.

The latest edition of the CEO Imperative Series finds near consensus among CEOs that a downturn is near, or already upon us. According to the January 2023 EY CEO Outlook Pulse study of 290 CEOs in the Asia-Pacific region, 99% of CEOs are actively planning for a downturn scenario.

Nearly three-quarters (72%) are preparing for a severe downturn in the region. However, almost half (49%) of CEOs are preparing for a severe downturn scenario that is temporary. This optimism for the transient nature of the recession rises significantly in China, where 83% of Chinese CEOs are planning for a downturn that is severe but short-lived.

The recent reopening of the Chinese economy has added another layer of uncertainty to the already ambiguous macro-economic environment. However, based on reopening lessons learned from other parts of the world, CEOs maintain a positive outlook that conditions will improve and growth will return in the second half of 2023.

While more than half of Asia-Pacific CEOs (56%) believe this slowdown will be different from previous slowdowns and 58% say it could be worse than the Global Financial Crisis (GFC) in terms of depth and severity, just under two-thirds (61%) have confidence that fiscal and policy decisions will ultimately shorten the length of the recession. This figure increases to 83% when only Chinese CEOs are considered.

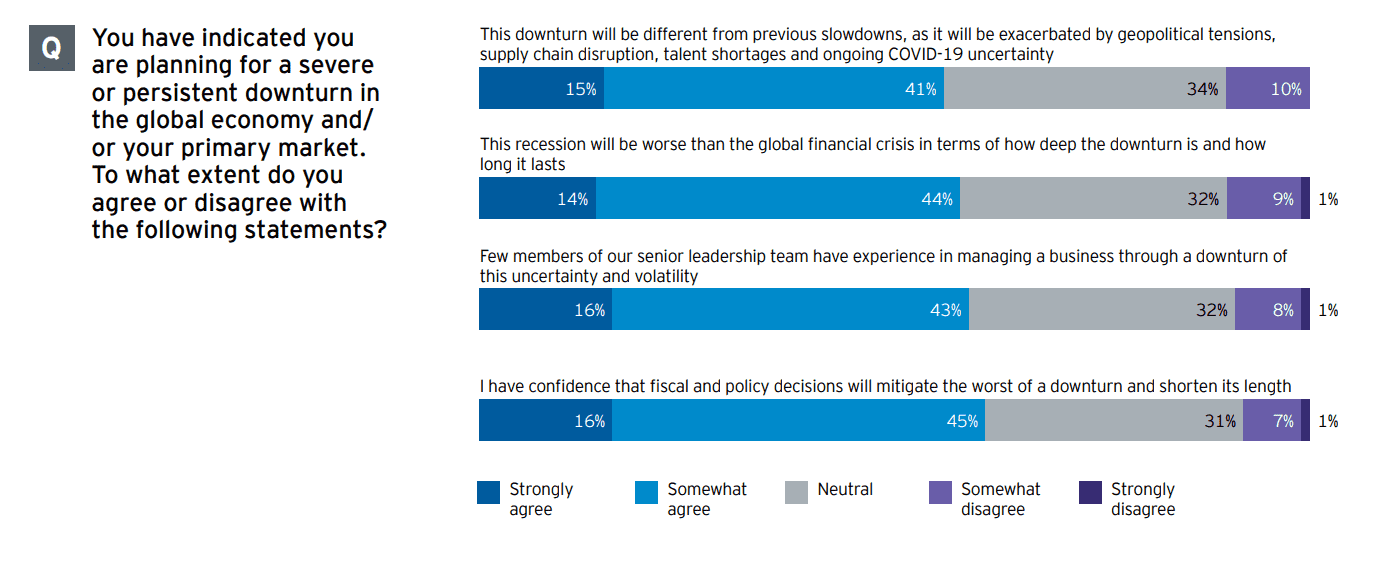

A chart showing the extent to which CEOs agree or disagree with these four statements:

- This downturn will be different from previous slowdowns, as it will be exacerbated by geopolitical tensions, supply chain disruption, talent shortages and ongoing COVID-19 uncertainty.

- This recession will be worse than the global financial crisis in terms of how deep the downturn is and how long it lasts.

- Few members of our senior leadership team have experience in managing a business through a downturn of this uncertainty and volatility.

- I have confidence that fiscal and policy decisions will mitigate the worst of a downturn and shorten its length.

The largest percent of those surveyed (41–45%) “somewhat agree” with each statement.

Pandemic-Related Issues No Longer Reign Supreme

In the period since the October 2022 EY CEO Outlook Pulse study (pdf), CEOs have markedly reassessed the greatest risks to the growth of their businesses. With China finally relaxing COVID-19 pandemic restrictions, just under a third (29%) of CEOs now consider pandemic-related disruptions as the greatest risk to the growth of their business, down from 48% in October 2022.

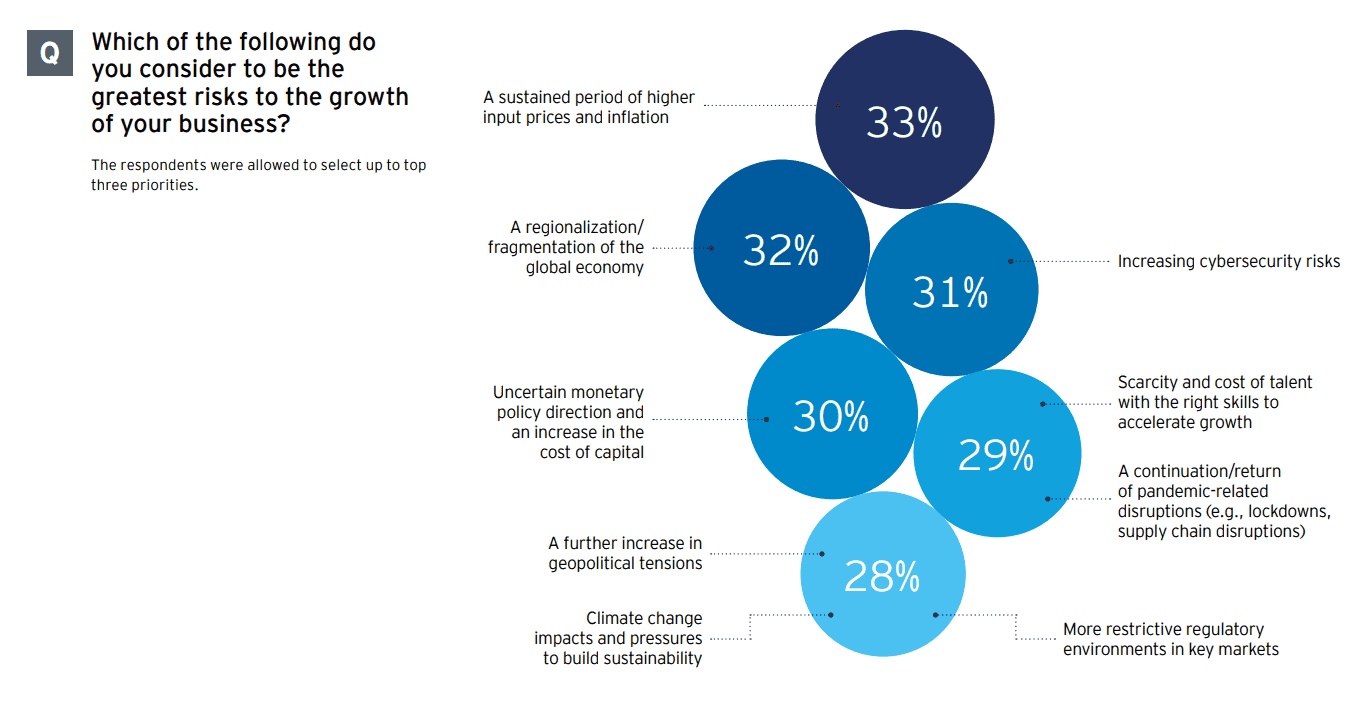

A chart showing what CEOs consider to be the greatest risks to their business. The risks most chosen were:

- A sustained period of higher input prices and inflation: 33%

- A regionalization or fragmentation of the global economy: 32%

- Increasing cybersecurity risks: 31%

Supply chain shocks stemming from pandemic-related restrictions are calming somewhat as China eases restrictions tied to its “zero-COVID” policy. This is a long-awaited relief for the region’s businesses whose supply chains are intricately linked with China. However, the net effect of this change on regional supply chains remains to be seen due to the speed with which the restrictions have been lifted.

With pandemic-related risks on the wane, CEOs across Asia-Pacific are turning their attention toward the challenges of higher input prices and higher cost of capital, amidst rising inflation and regionalization of the global economy. The Chinese government’s decision to relax several COVID-19 measures and have its borders reopen to the world is expected to bring the issue of escalating inflation to the fore. Almost all major Asia-Pacific countries experienced high inflation in 20221, with the impact expected to continue at least into the first half of 2023, before gradually easing.

To tackle inflation, most of the central banks in Asia-Pacific (except for China and Japan) have significantly raised their interest rates, leading to an increase in cost of capital. Cost pressures have been further elevated by a regionalization and fragmentation of the global economy through disrupted supply chains and higher input costs, as well as energy price spikes.

CEOs Need to Play Both Offense and Defense to be Future-Fit

Anticipating a shorter but more severe recession, CEOs across Asia-Pacific are making strategic choices that emphasize resiliency, efficiency and quality; switching gears from years of rapid growth and scale.

How CEOs achieve this defensive posture is crucial: CEOs must find the right balance between building up a solid-enough shield to weather the severe part of the downturn, and overprotecting, which could leave organizations poorly positioned to accelerate back to growth when the shorter downturn ends abruptly.

Surviving the downturn is important, but CEOs are already looking ahead to shore up their market position. The survey finds the attention of Asia-Pacific CEOs almost evenly split between defensive measures like adapting supply chain for resiliency, divesting low performing business units, and shoring up quality talent; and offensive measures such as investing in early-stage businesses, acquiring businesses in adjacent sectors, and building up sustainability or ESG capabilities to engage customers.

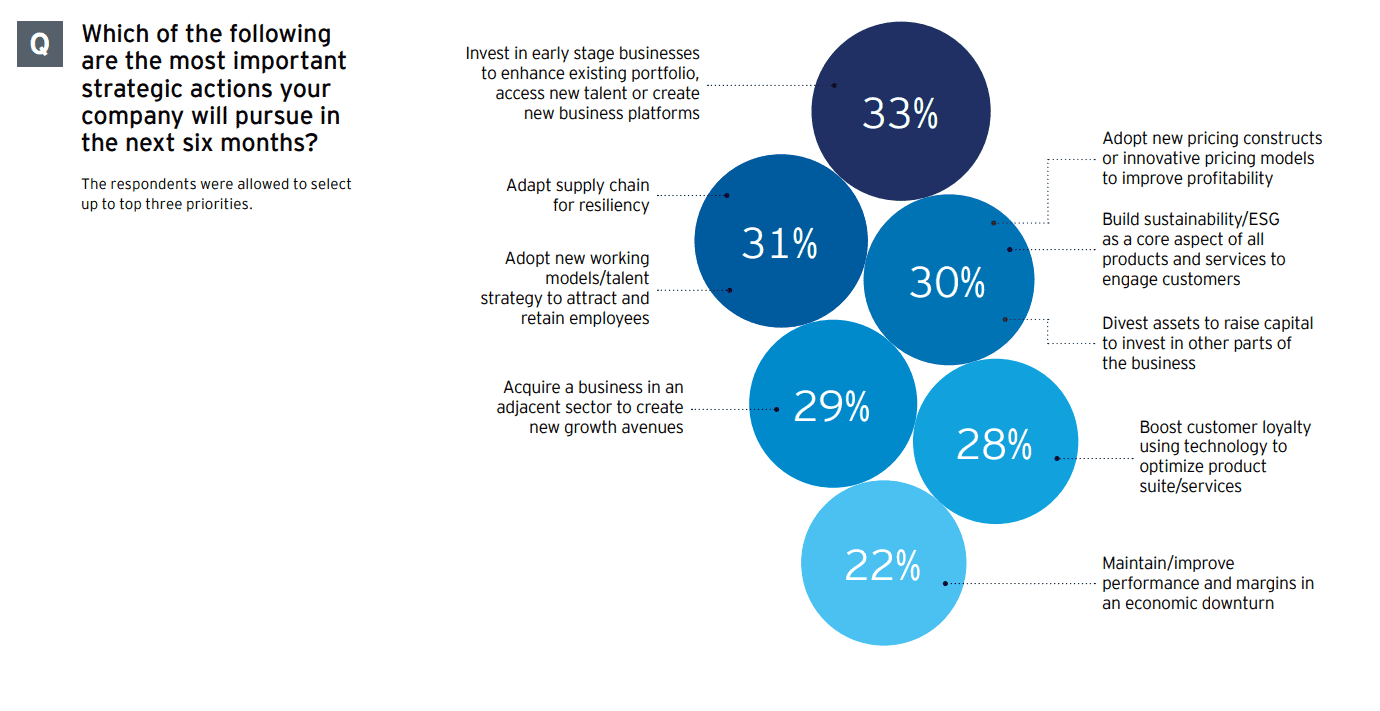

A chart showing strategic actions companies will pursue in the next six months, with the highest responses being:

- Invest in early-state businesses to enhance existing portfolio, access new talent or create new business platforms (33%)

- Adapt supply chain for resiliency (31%)

- Adopt new working models or talent strategy to attract and retain employees (31%)

CEOs Optimize to Weather the Short-Term Storm

To make businesses leaner and more efficient for the downturn, CEOs are reviewing and optimizing capital expenditures, working capital and corporate finance management. They are identifying underperforming business units for improvement or divestment, with divestment proceeds channeled toward more profitable businesses or investment opportunities that enhance existing portfolio, allow access to new talent or create new business platforms.

More than half (54%) of CEOs consider outsourcing and managed services very important to manage fixed costs and shift risk. This goes beyond traditional business process outsourcing like payroll, to include higher-value functions like research, analytics and risk management.

Businesses that have invested heavily in digital transformation during the COVID-19 pandemic are being rewarded with the operational advantages of being a digital organization. These businesses and others are doubling down, with 98% of CEOs saying it is important to continue their digital and technology transformation to deliver revenue growth and leverage operational advantages.

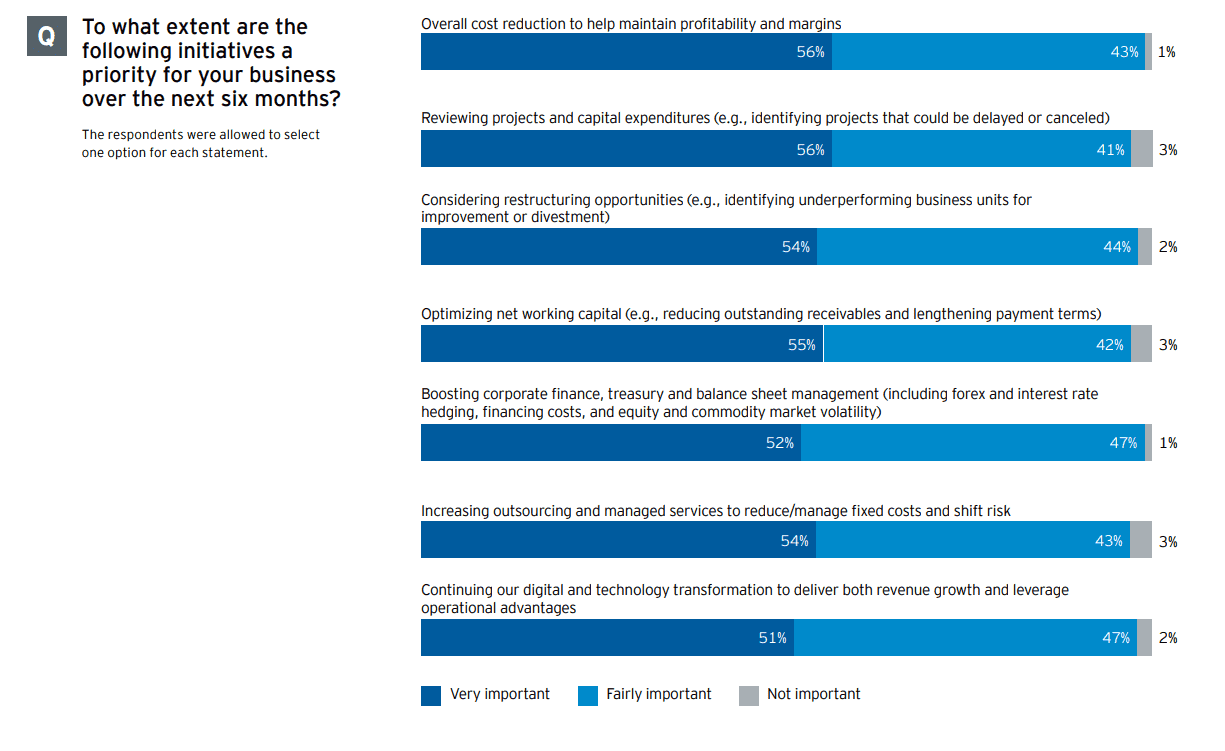

A chart showing the importance of the following initiatives to businesses for the next six months:

- Overall cost reduction to help maintain probability and margins

- Reviewing projects and capital expenditures (e.g., identifying projects that could be delayed or canceled)

- Considering restructuring opportunities (e.g., identifying underperforming business units for improvement or divestment)

- Optimizing net working capital (e.g., reducing outstanding receivables and lengthening payment terms)

- Boosting corporate finance, treasury and balance sheet management (including forex and interest rate hedging, financing costs, and equity and commodity market volatility)

- Increasing outsourcing and managed services to reduce or manage fixed costs and shift risk

- Continuing our digital and technology transformation to deliver both revenue growth and leverage operational advantages

The largest percent of those surveyed (51–56%) consider each initiative “very important.”

Asia-Pacific CEOs Stay Focused on the Future to Emerge From Recession Stronger

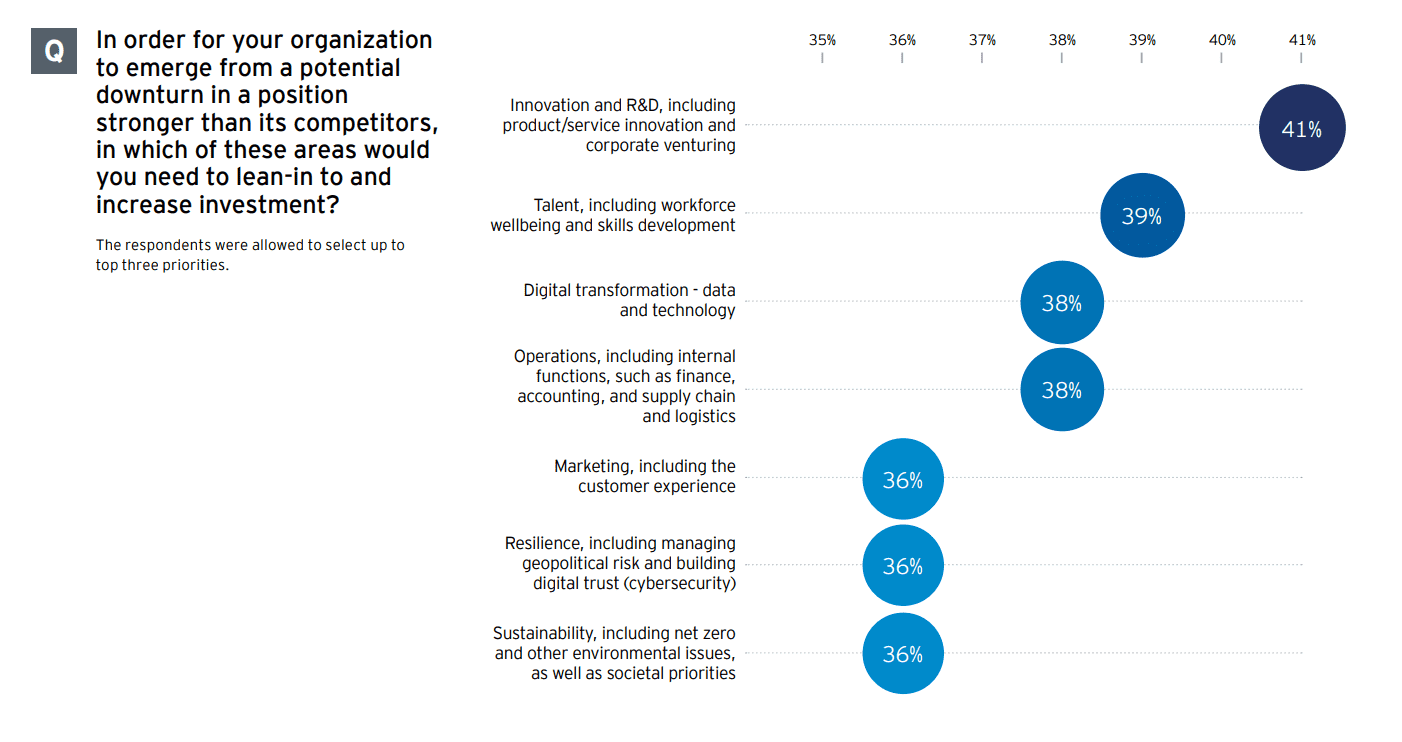

Careful to avoid repeating the long-haul flight to safety many organizations took during the GFC, CEOs are leaning into and increasing investment in areas that will see them emerge from the downturn stronger than their competitors. Two-fifths (41%) of respondents are planning to increase investment in innovation and research and development, including product and service innovation and corporate venturing. In addition, more than a third (38%) plan to increase their investment in digital transformation initiatives centered around data and technology.

A chart showing the areas CEOs need to lean into and increase investment, with the following deemed as primary investment areas:

- Digital transformation — data and technology (16%)

- Resilience, including managing geopolitical risk and building digital trust (cybersecurity) (15%)

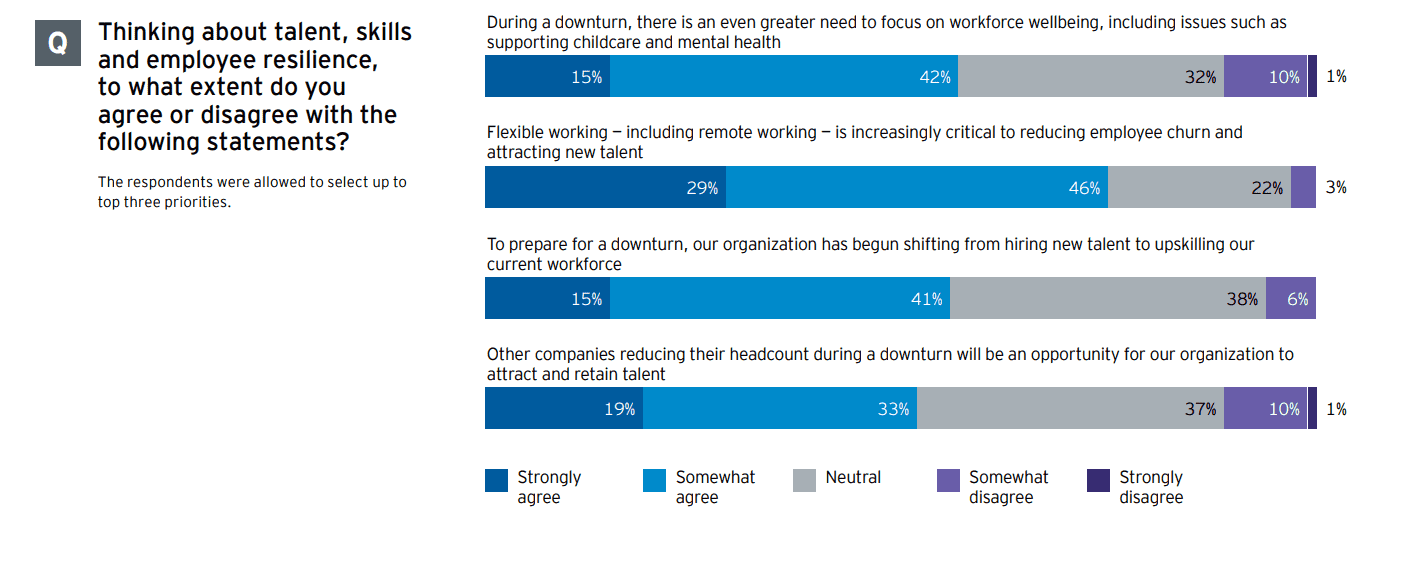

Unsurprisingly, 39% of respondents cite talent, including workforce wellbeing and skills development, as a priority for further investment. Three-quarters of CEOs (75%) agree that flexible working will be critical to reducing employee churn and attracting new talent, while more than half (56%) have already begun shifting from hiring new talent to upskilling their existing workforces.

A chart showing the degree to which CEOs agree or disagree with the following statements:

- During a downturn, there is an even greater need to focus on workforce wellbeing, including issues such as childcare and mental health

- Flexible working — including remote working — is increasingly critical to reducing employee churn and attracting new talent

- To prepare for a downturn, our organization has begun shifting from hiring new talent to upskilling our current workforce

- Other companies reducing their headcount during a downturn will be an opportunity for our organization to attract and retain talent

The largest percent of those surveyed (33–46%) “somewhat agrees” to each statement.

Portfolio Transformation is Still High on the Agenda, but Deals Will More Likely be Between Allies

In line with their expectation of a short but severe recession, CEOs in Asia-Pacific are sharpening their focus to make sure they are investing in the right bets, managing the fine balance between short-term profitability and long-term value creation. Most CEOs (84%) in Asia-Pacific expect to actively pursue some form of transaction over the next 12 months. However, they are being more surgical in their approach. They are pursuing JVs and alliances to gain exposure to strategic parts of a business before, or in-lieu of, a more capital-intensive merger or acquisition.

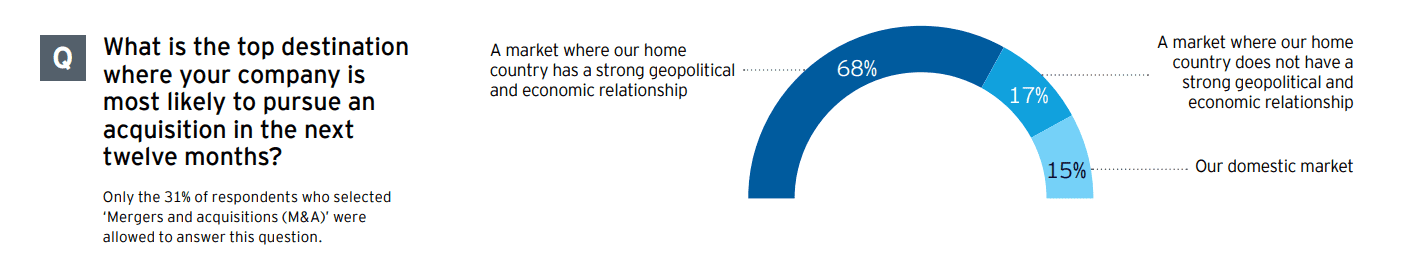

A chart showing that 31% of CEOs who are expecting to actively pursue M&A in the next 12 months would likely pursue it in “a market where our home country has a strong geopolitical and economic relationship.”

This said, there is no one-size-fits-all approach to dealmaking within the region. For example, Australian (43%), Singaporean (43%) and Japanese (40%) CEOs are still keen on M&A as a mode of transaction over the next 12 months. In comparison, only 6% of Chinese CEOs and 28% of South Korean CEOs indicate they will pursue M&A within the same period.

Geopolitical factors are also more prominent when pursuing a merger or acquisition target, with 68% of Asia-Pacific CEOs preferring a market where their home country has a strong geopolitical and economic relationship. The relative certainty around free trade and capital flow among allies gives CEOs the confidence that there will be minimal disruption to their key operations and supply chains.

Cautiously Optimistic CEOs Can Capture Opportunities in 2023

The start of 2023 offers a glimmer of hope, with signs that several key macroeconomic and geopolitical challenges may be abating. While new challenges will certainly arise, CEOs need to demonstrate strategic and decisive leadership to steer their organizations through these challenges and emerge from the storm more resilient and better positioned than their competitors. This calls for greater client centricity and market attunement, future-proofing organizations via transformation, and bolder investments in the capabilities of tomorrow.

5 Key Considerations for Asia-Pacific CEOs in 2023

- Prepare for multiple scenarios. CEOs should prepare multiple business scenarios to address a quickly changing macroeconomic and geopolitical landscape in Asia-Pacific. They should be ready to switch between likely scenarios as things evolve and making quick decisions on buying, building, partnering – or letting go.

- Make informed decisions based on data. From cybersecurity to supply chain risk management, Asia-Pacific CEOs should make use of data analytics to manage risks in real time and inform critical decisions that need to be made with short notice.

- Look up to see farther. CEOs in Asia-Pacific need to look beyond managing through near-term complexities and challenges and remain focused on longer-term opportunities for growth.

- Stay close to the customer. Whether it’s investing in new technology to foster loyalty or continuing to align with ever-increasing ESG expectations, Asia-Pacific CEOs should remain laser-focused on their consumers through turbulent times.

- Be bolder by design. Previous recessions have shown that CEOs who invested in future capabilities during the downturn benefited the most during the upturn. Being bold to accelerate business strategy could pay dividends at a later date.

5.0

5.0